The Next Decade of Insurance with AI Agents

Executive summary

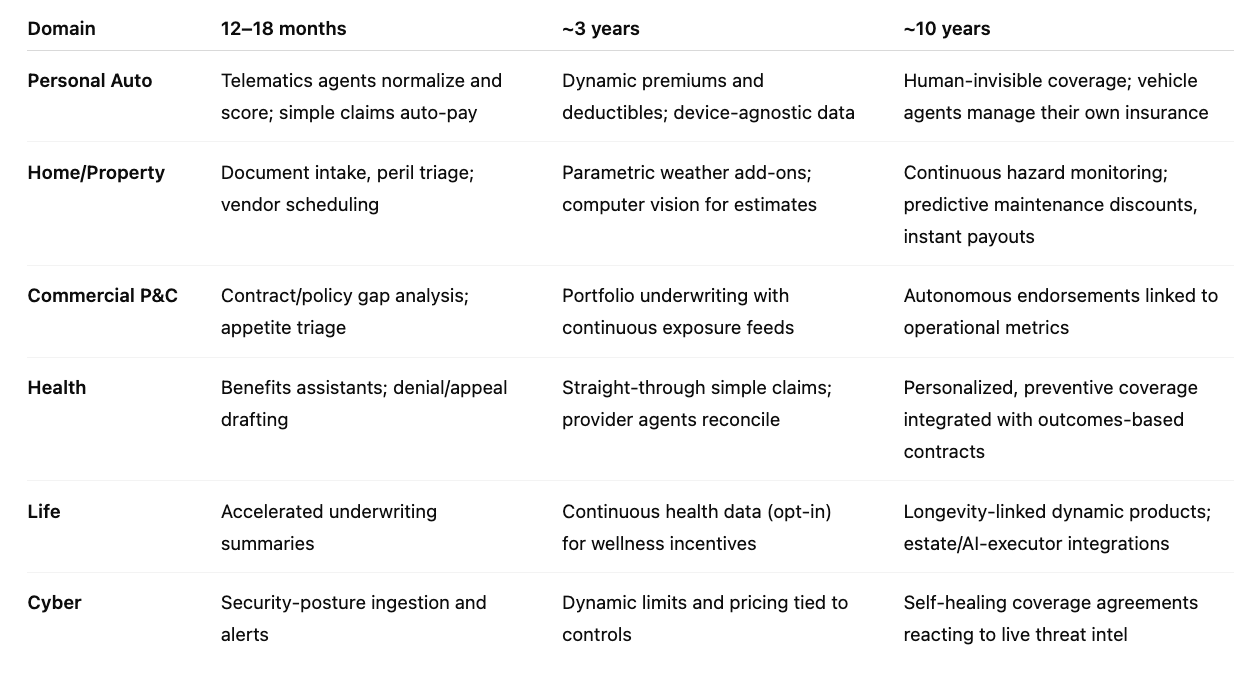

AI agents—autonomous but governed software teammates that read, reason, and act across systems—will transition insurance from a reactive, paperwork-heavy business into a proactive “risk operating system.” The near term is about efficiency and data extraction; the mid term about embedded, personalized, and preventive products; the long term about continuous, ambient coverage and machine customers transacting directly.

12–18 months: Rapid productivity gains from agentic automation in distribution, underwriting support, and claims triage. Human-in-the-loop remains the operating norm. Carriers and brokers ship targeted agents (document intake, policy comparison, FNOL triage, subrogation support, benefits assistants).

~3 years: Embedded/on-demand insurance at scale; proactive risk management and dynamic endorsements; straight-through processing for simple claims; portfolio-level underwriting augmented by agents; rigorous AI governance integrated into Model Risk Management.

~10 years: Always-on, usage-based, and parametric products become mainstream; autonomous “machine customers” purchase and manage coverage; re/insurance capital allocates in near-real time to agent-verified risks; fairness, explainability, and privacy become differentiators, not just obligations.

Newfront’s trajectory illustrates the pattern: apply LLMs to “read” unstructured contracts and policies, highlight coverage gaps instantly (Contract Review Tool), and deploy domain agents like Benji to resolve benefits queries—while keeping experts in the loop. That blueprint generalizes across commercial and personal lines.

What AI agents are (and why they’re different)

Perception: Read documents, emails, chats, images, telemetry, and third-party data.

Reasoning: Use domain tools (rating, rules engines, policy libraries) and chain-of-thought planning to reach decisions.

Action: Create tasks, draft endorsements, update core systems, trigger payments—always gated by guardrails and approvals.

Memory & governance: Maintain secured, scoped memory; log decisions with reasons; enforce entitlements; route to humans when uncertain.

Patterns: single skilled agents for narrow tasks; multi-agent teams for complex workflows (e.g., one agent to parse a contract, another to compare coverage, another to draft recommendations); and human-in-the-loop checkpoints at material-risk steps.

Baseline (2025)

Core systems still dominate the “system of record,” with data locked in PDFs, emails, and legacy screens.

Point automations exist (OCR, RPA), but they lack reasoning, context, or safe autonomy.

Early movers use LLMs to parse contracts/policies, summarize accounts, and speed up service interactions; domain agents answer routine questions and fill forms.

12–18 months: What changes, concretely

Distribution & client service

Agent-copilot workbenches: Summarize accounts, pull key exposures, draft proposals, answer routine client questions, and prep renewal packs.

Benefits assistants: Always-available agents (Slack/mobile/web) that answer coverage, plan, and network questions; escalate edge cases to HR or brokers.

Sales enablement: Agents assemble tailored decks, loss runs, testimonials, and compliance attachments in minutes, not days.

Underwriting & pricing

Contract/policy comprehension: Upload a contract; agents extract insurance requirements, compare to the insured’s schedule, and flag gaps or additional insured language—instantly.

Submission triage: Agents normalize ACORDs and broker emails; enrich with public/private data; recommend appetite fit; book clean risks straight through to underwriter review.

Exposure enrichment: Pull from internal notes, loss runs, IoT/telematics, and third-party datasets to sharpen pricing.

Claims & SIU

FNOL triage: Agents classify, de-duplicate, and route; request missing documents; schedule vendors; draft initial correspondence.

Straight-through simple claims: Dental, travel delay, small property—auto-adjudicated with risk-based sampling for QA.

Subrogation & salvage: Agents detect recovery opportunities early; draft demands; track negotiations across parties.

Risk engineering & loss control

Proactive nudges: Weather perils, maintenance windows, or driver safety alerts, with measurable loss-cost impact.

Compliance & model risk

Governed autonomy: Decision logs, reason traces, dataset/version lineage, and human approval steps integrated with existing Model Risk Management.

Expected outcomes (typical ranges):

20–40% faster cycle times on document-heavy tasks

10–25% reduction in leakage for targeted claim types

15–30% productivity uplift for frontline teams

Improved NPS/CSAT from faster, clearer communication

~3 years: The operating model flips from reactive to proactive

Embedded and on-demand insurance

Point-of-sale coverage is the norm across mobility, travel, events, equipment, SaaS SLAs, and B2B marketplaces. AI agents price and bind micro-policies in context.

Hyper-personalization & dynamic endorsements

Continuous underwriting for SMB and selected mid-market risks: policy terms and deductibles adjust on triggers (e.g., security posture, maintenance logs, driver behavior) with clear consent and audit.

Claims transformation

Near-instant payouts for well-instrumented perils (parametric travel, cargo, and selected property); complex claims focus human expertise on causation, liability, and negotiation—with agents preparing evidence and drafting settlements.

Fraud & financial crime

Graph-aware agents flag rings and anomalies across carriers and suppliers; explainable alerts reduce adjuster fatigue and false positives.

Workforce & organization

Hybrid roles: Underwriters become portfolio stewards; adjusters become experience managers; brokers become strategic advisors.

Agent operations (AIOps): A dedicated team monitors, tests, and improves agents; red-teams probe for jailbreaks, bias, and data leakage.

Governance maturation

AI policy as code: Standardized controls (e.g., PII redaction, fairness monitors, approval thresholds) ship with every agent; audit-ready logs feed compliance reporting.

EU/US/state frameworks are embedded in tooling (consent, transparency, human oversight, recordkeeping).

~10 years: Insurance becomes a “risk operating system”

Ambient, event-driven coverage

Always-on protection: Coverage attaches to activities and assets automatically (drive, ship, build, operate); triggers and telemetry validate events and issue payments.

Parametric mainstream: Climate, supply chain, cyber-service levels, and even operational KPIs drive objective payouts, with capital markets absorbing tail risk dynamically.

Machine customers and autonomous assets

Bots buy insurance: Vehicles, fleets, robots, and software agents quote, purchase, and manage coverage based on risk posture and objectives—within pre-approved guardrails set by owners.

Autonomous negotiations: Agents negotiate endorsements and limits inside digital ecosystems (cloud, logistics, industrial IoT).

Capital & reinsurance

Programmable reinsurance: Smart contracts (not necessarily blockchain) and agent-verified risk metrics allow near-real-time placement and retrocession; cat capacity shifts as hazard signals evolve.

Trust as a competitive moat

Explanations on demand: Every price, decision, or denial ships with a clear, testable rationale.

Fairness & privacy: Differential privacy, secure enclaves, and federated learning are table stakes.

Human expertise re-centered: People govern boundaries, arbitrate hard trade-offs, and design products; agents do the grinding work.

Architecture blueprint for agentic insurance

Data plane:

Document intelligence (policies, endorsements, contracts, loss runs, invoices)

Stream ingestion (telematics, IoT, weather, payment, audit logs)

Feature store + vector search over policy/claims corpora

Reasoning plane:

Foundation models + domain adapters (policy language, legal, medical, actuarial)

Toolformer pattern: rating engines, rules engines, geospatial, computer vision

Multi-agent orchestration (planning, delegation, negotiation)

Control plane (governance & safety):

Role-based access, data minimization, PHI/PII redaction

Guardrails (allow/deny lists, retrieval scopes, cost/timeouts, certainty thresholds)

Decision logging, explanation capture, fairness/robustness monitors

Human approval checkpoints for material changes (bind, pay, deny, rescind)

Integration plane:

Connectors to core admin systems (policy, billing, claims), CRM, email, portals

Event bus for triggers (FNOL created, cat alert, premium past-due, control failed)

API “facades” to wrap brittle legacy endpoints with stable contracts

Governance, risk, and compliance (GxP)

Model Risk Management: Inventory models/agents; document purpose, data, limits; require challenger tests and sign-offs.

Responsible AI: Test for disparate impact; monitor drift; publish model cards; provide human contact for contesting decisions.

Data protection: Privacy by design, least privilege, consent tracking, retention schedules, breach playbooks.

Operational resilience: Sandboxes, kill-switches, circuit breakers, canary releases, chaos engineering for agents.

Economics & ROI (indicative)

Claims: 10–20% cost-to-serve reduction on targeted cohorts; 1–2 point loss-ratio improvement from faster triage and fraud picks.

Underwriting: 15–25% throughput uplift; 5–10% better hit/close rates from faster quotes and clearer proposals.

Service: 20–40% handle-time reduction; improved retention from faster, more accurate responses.

IT/Ops: Decreased swivel-chair work; lower vendor ticket volume via agent self-healing scripts.

Implementation roadmap

0–90 days (foundation & quick wins)

Establish an AI Risk & Governance Council and a lightweight policy.

Stand up a secure agent platform (sandbox, logging, guardrails).

Ship 2–3 low-risk agents: document intake/classification; contract-to-policy gap flagger; renewal pack summarizer.

Define success metrics and baselines (cycle time, touch count, accuracy, leakage).

3–12 months (scale across value chain)

Add FNOL triage and vendor-scheduling agents with human approvals.

Pilot embedded micro-products in one partner channel.

Integrate fairness tests and red-teaming into CI/CD for agents.

Launch service/benefits assistants; expand to multilingual.

12–36 months (operate with confidence)

Expand to straight-through processing for simple claims with sampling QA.

Portfolio-level underwriting copilot with continuous exposure feeds.

Formalize AgentOps (observability, cost controls, reliability SLOs).

Productize dynamic endorsements and parametric riders where data supports it.

KPIs & leading indicators

Throughput & latency: Time to quote/bind/pay; days to close claim; first-contact resolution.

Quality: Accuracy vs. gold standards; leakage; re-open rates; false-positive fraud rate.

Fairness & trust: Adverse impact metrics; opt-out rates; complaint ratios; explanation satisfaction.

Adoption & economics: % of workflows agent-assisted; human overrides; unit costs; loss-ratio/combined-ratio movements.

Resilience: Agent SLO adherence; incident Mean Time to Detect/Recover; drift alerts resolved.

Build vs. buy: a pragmatic stance

Buy accelerators where the domain is mature (document intelligence, contact center copilots, fraud orchestration, contract comparison).

Build the orchestration, guardrails, and domain logic that encode your risk philosophy, distribution strategy, and brand experience.

Co-create with strategic partners for embedded distribution and parametric data channels.

Risks and how to mitigate them

Hallucinations / over-confidence: Require retrieval-grounding, uncertainty estimation, and human approval for material actions.

Bias & unfair pricing: Use representative datasets, counterfactual testing, and post-processing fairness constraints; provide clear appeals paths.

Data leakage/IP exposure: Strict data-scoping; redact before inference; private endpoints; contractual controls with vendors.

Legacy integration fragility: Wrap legacy with resilient APIs; add retries, back-pressure, and circuit breakers.

Change fatigue: Invest in training, role redesign, and transparent comms; show quick, credible wins.

Mini-case patterns you can replicate

Contract Review Agent (commercial): Parse indemnity and insurance requirements; compare against policy schedules; recommend endorsements and limits; produce client-ready gap memos.

Benefits Assistant (group/benefits): Answer plan FAQs, find in-network providers, explain EOBs; escalate to HR/broker when confidence is low.

Claims Triage Agent (property): Intake photos, weather data, and FNOL notes; estimate severity; auto-assign vendors; draft customer updates.

SMB Appetite Router (underwriting): Normalize submissions; enrich with external data; score fit; return quotes or route with rationale.

Scenarios for ~10 years

Accelerated: Ubiquitous telemetry and clear regulation drive ambient coverage, parametric adoption, and machine-customer markets; combined ratios improve structurally.

Base case: Hybrid human-AI becomes industry standard; embedded products common; regulatory clarity achieved; steady ROE uplift.

Cautious: Data-access constraints and fragmented rules slow progress; gains concentrate in document/process automation while structural products (parametric, dynamic) adopt more slowly.

What to do next (action checklist)

Name an accountable Head of Agentic Insurance (business + tech + risk).

Stand up a governed sandbox and pilot three agents in 90 days.

Choose two lines of business for depth (e.g., commercial property + health benefits).

Secure data partnerships that enable parametric/dynamic products (weather, IoT, cyber posture).

Embed AgentOps and Responsible AI into delivery—observability, red-team, fairness checks, human approval maps.

Publish a North-Star architecture and a 3-year capability roadmap tied to financial KPIs.

Closing note

In the next year, AI agents will measurably compress cycle times and costs. In three years, they’ll recast the operating model around prevention, personalization, and embedded distribution. In ten years, insurance behaves like ambient infrastructure—quietly synchronizing people, assets, and capital with real-world risk—while human experts focus on judgment, trust, and the design of better protections.