Understanding the Customer Conversation

The Rise of Conversational Commerce

What is conversational commerce? Conversational commerce is the fusion of shopping with real-time dialogue. At its core, it uses technology to enable personalized, two-way communication between a business and its customers at scale. In practice, this means brands engage shoppers through chat apps, messaging platforms, voice assistants, and chatbots to answer questions, offer advice, and even facilitate purchases. The most advanced implementations leverage interactive AI to power conversations across websites, social messaging apps, and smart speakers. These tools help solve problems, recommend products, and answer questions “to guide customers toward confident decisions”. In short, conversational commerce brings back the human touch that’s been missing from e-commerce, making online shopping feel less like clicking through a catalog and more like chatting with a helpful store associate.

Why is conversational commerce on the rise? The modern consumer increasingly expects instant, personal interaction in their buying journey. Imagine a shopper browsing an online store who has a question about a product’s features or fit. In the past, finding the answer might involve combing through product descriptions or waiting on hold for a call center. Today, shoppers can open a chat window or send a message on social media and get answers in real-time. This shift is driven by consumer frustration with one-way communication – a majority of people (53%) feel frustrated when they get a business message they can’t respond to. In fact, 71% of online shoppers now expect real-time communication with brands, and over a third prefer to use messaging channels for customer service. These changing preferences, combined with the ubiquity of smartphones and messaging apps, have created fertile ground for conversational commerce. Brands that enable quick, two-way conversations are meeting customers where they already spend their time. Whether it’s answering a question on a website live chat or helping a user via WhatsApp, being conversational isn’t just a nicety – it’s increasingly a necessity for competitive advantage.

Customer questions as sales drivers. One of the strongest arguments for conversational commerce is the simple fact that customer questions drive sales. When a shopper asks a question – “Is this available in my size?”, “Will this work with my existing setup?”, “What’s the difference between these two models?” – they are signaling genuine interest and intent to buy. These queries aren’t just support issues; they’re buying signals. If the customer didn’t care or wasn’t serious about a purchase, they likely wouldn’t take the time to ask. Studies confirm that shoppers who get their questions answered tend to convert at higher rates. For example, an analysis of user behavior found that consumers who interact with Q&A content on product pages convert at 157% the rate of those who don’t. Conversely, if their questions go unanswered, the sale can slip away. As an illustration, consider your own habits: have you ever been shopping online and had a critical question, only to find no answer? If you’re like most people, you probably left the site and looked elsewhere. This is a common scenario – roughly half of shoppers have abandoned a purchase because they couldn’t find sufficient information or answers about a product. The absence of Q&A content even makes some consumers suspicious: one survey found 26% of shoppers doubt a product’s quality if its page has no Q&A, and a similar portion say they’re less likely to buy that product without this questions-and-answers section. On the flip side, when Q&A is present and active, it builds trust and clarity. PowerReviews, surveying 7,500 consumers, found that virtually all shoppers (99%) read Q&A at least occasionally, and 72% do so regularly, primarily to understand product performance, fit, or sizing. The takeaway for brands and e-commerce professionals is clear: every customer question is an opportunity. It’s a chance to remove doubt, provide reassurance, and nudge the customer toward checkout. Brands that recognize a question like “Does this come in a medium?” as a moment of truth – the exact instant a customer teeters between buying and bouncing – can treat the answer as a strategic lever for conversion. Indeed, forward-thinking companies are beginning to turn every customer conversation into a sales moment. They know that the moment of uncertainty before purchase is often the biggest revenue opportunity.

The role of AI in modern customer interactions. None of this would be scalable without artificial intelligence. The rise of conversational commerce has coincided with rapid advances in AI, allowing brands to engage millions of customers personally without hiring an army of agents. AI plays multiple roles in modern customer interactions:

24/7 Availability: AI-powered chatbots can handle inquiries at any hour, ensuring that product questions don’t go unanswered just because it’s 2 AM or a public holiday. In the context of retail, where “product questions don't follow business hours,” AI steps in to work around the clock so that sales opportunities aren’t missed due to timing.

Instant Answers at Scale: With natural language processing, AI chatbots can understand a huge variety of customer queries and retrieve the appropriate answers in milliseconds. They excel at answering repetitive questions – like shipping options or basic specs – immediately. This satisfies the modern consumer’s desire for instant gratification. (Notably, 51% of consumers say they prefer interacting with a bot if it means immediate assistance.) When an AI chatbot can instantly confirm that “yes, this phone case is compatible with your model” or “yes, we ship to your country”, it removes barriers to buying. Brands like Amazon have trained shoppers to expect quick answers, and AI is how smaller brands can meet those expectations.

Personalized Guidance: Today’s conversational AI systems don’t just serve FAQ answers – they can also make personalized recommendations. For example, an AI assistant on an apparel site might suggest a complementary accessory when a customer asks about a dress, much like a skilled salesperson would. These systems draw on customer data (past purchases, browsing history) to tailor the conversation. The result is an interaction that feels one-to-one. As one industry expert put it, this is “AI that thinks like your best salesperson while maintaining the helpful, authentic tone your customers trust.” It’s not about robotic upselling, but genuinely understanding what would add value to the customer’s experience.

Seamless Handoffs to Humans: The goal of AI in customer engagement isn’t to eliminate humans, but to use them wisely. When a conversation becomes too complex or emotional, smart systems pass the context to a human agent. The best setups ensure a seamless transition with full conversation history, so the customer isn’t forced to repeat themselves. AI can handle the “easy” questions and identify conversations that indicate serious purchase intent or special needs, flagging those for human follow-up. This hybrid approach increases efficiency and maintains a high-quality customer experience.

Consistency and Brand Voice: AI also helps enforce consistency in answers. A well-trained conversational AI (sometimes referred to as a Conversational Commerce Intelligence System, or CCIS) draws from a single, vetted knowledge base. It will give the same accurate answer about, say, a product’s ingredients or warranty, whether the customer asks on Facebook Messenger or the website chat. Moreover, brands can train AI to respond in the company’s unique tone and style, ensuring brand-aligned answers every time. This alignment is crucial for maintaining trust. AI doesn’t forget or go off-script – if programmed correctly, it will faithfully echo the brand’s messaging and values in every customer interaction.

The impact of AI on customer interactions is already profound and growing. By 2025, AI is expected to handle as much as 95% of all customer interactions – from answering product questions to helping track orders – via automated chat, voice, or email responses. And companies are rapidly adopting these technologies: 80% of businesses report they are using or planning to use AI chatbots for customer service by 2025. For brand managers and CX strategists, the takeaway is that AI isn’t a futuristic buzzword; it’s here now, powering the conversational experiences that customers increasingly demand. The brands that succeed in conversational commerce will be those that combine the efficiency of AI with the empathy and strategic insight of human agents. Together, they can ensure that whenever a customer has a question – no matter where or when it arises – the brand is ready to answer promptly, helpfully, and in a way that drives the sale.

Transition: We’ve seen that conversational commerce is transforming how businesses engage customers, turning questions into conversions and leveraging AI to scale personalized service. But to truly capitalize on this trend, brands must first understand the raw material feeding these conversations: the questions themselves. Where are customers voicing their curiosities and concerns? And what exactly are they asking at each stage of their journey? In the next chapter, we move from the concept to the data – exploring the sources of customer questions and how we can turn scattered inquiries into rich dialogue.

From Data to Dialogue

Sources of customer questions. Customer questions are everywhere, streaming in from a multitude of channels in today’s omnichannel commerce environment. To craft a successful conversational commerce strategy, brands need to gather and analyze questions from all major touchpoints:

E-commerce Platforms (e.g., Amazon): A treasure trove of customer curiosity lives on retail sites like Amazon, where the Customer Questions & Answers section on product pages lets shoppers ask anything they want. For instance, on a Ferrero Rocher chocolate gift box page, someone might ask “Will these chocolates be shipped with cold packs so they won’t melt?” or “What is the expiration date on this pack?” These questions – visible to all potential buyers – highlight information not obvious from the product description. Amazon’s Q&A is a goldmine because it captures pre-purchase questions at scale. According to industry research, 68% of consumers have left a question on a product page’s Q&A section. Smart brands monitor these and even participate by providing authoritative answers. It’s worth noting that shoppers pay close attention to who answers – 94% of consumers value answers from verified buyers, but nearly half also value answers from the brand or retailer itself. In other words, if the brand steps in on Amazon to answer a question accurately, many shoppers take that answer to the bank.

Brand Websites and E-commerce Stores: On a company’s own website, questions surface via multiple avenues. There’s traditional FAQ pages and knowledge bases that list common queries. There’s also on-site search bars (where the questions are implicit in the keywords customers type) and support/contact forms where customers submit inquiries. Increasingly, brands are deploying live chat widgets or chatbot pop-ups on their sites, inviting visitors to “Ask me anything.” These chats capture questions in real time. For example, a visitor on Ferrero’s site might open a chat to ask if a new hazelnut spread is gluten-free or how to find a nearby retailer. Each query is a data point. Even if the site has an FAQ, the questions customers actively ask in chat or forms can reveal gaps in information architecture. Leading companies feed these questions back into improving content – if multiple people ask “Is Product X recyclable?”, that’s a cue to add that info on the product page.

Social Media and Community Forums: In the social sphere, customers voice questions on brand Facebook pages, Twitter (X) replies, Instagram comments, Reddit threads, and more. A consumer might tweet at a telecom brand, “Do you guys offer 5G coverage in my area?” or ask on an Instagram post of a new sneaker, “When will this be back in stock in size 9?” Social media’s public, real-time nature means these questions often occur in the moment of discovery. They can quickly gain visibility – for better or worse. If the brand responds quickly with a helpful answer, it demonstrates responsiveness not just to one person but to the whole audience watching. If such questions go unanswered or the response languishes for days, it can dent the brand’s image of attentiveness. Additionally, community forums and third-party review sites host questions. Think of discussion threads on Reddit like “What’s the best dairy-free chocolate?” where a brand like Ferrero could be mentioned and questions asked about its ingredients. Savvy companies keep ears on these channels, either through social listening tools or dedicated community engagement teams, to scoop up recurring questions and even jump into conversations where appropriate.

Chatbots and Messaging Apps: The proliferation of messaging channels has created new Q&A streams. Customers now engage brands on WhatsApp, Facebook Messenger, WeChat, or via SMS. They might message a makeup brand on WhatsApp with, “Hi, I have oily skin, which of your moisturizers would you recommend?” These are highly conversational and often one-on-one, which can yield incredibly granular insights into customer needs. Chatbots on these platforms often handle first-line inquiries and log volumes of data. A bot might get thousands of variations of “Where’s my order?” or “How do I apply a promo code?” indicating what information or site functionality might be improved. Likewise, voice assistants (Alexa, Google Assistant) represent an emerging source – customers literally ask their devices about products (“Alexa, ask Brand X what the calorie count is in their protein bar”). In all cases, these questions via chat or voice are data that can be mined to understand consumer intent and pain points.

Collecting questions from these varied sources is the first step. Many brands are now deploying Conversational Intelligence Systems to unify this data. Such systems aggregate questions from Amazon listings, site chats, social media, etc., into one database. By breaking down silos, a brand manager can see the full spectrum of what customers are asking, regardless of channel. As Shopify’s best practices suggest, the best place to start is your own customer data – support tickets, feedback forms, and chat logs – to find the most frequently asked questions. Then you can enrich that by looking outward: competitor FAQs, forums, and review sites can reveal questions people have about similar products. The goal is to leave no stone unturned, because every channel might highlight a different facet of customer curiosity.

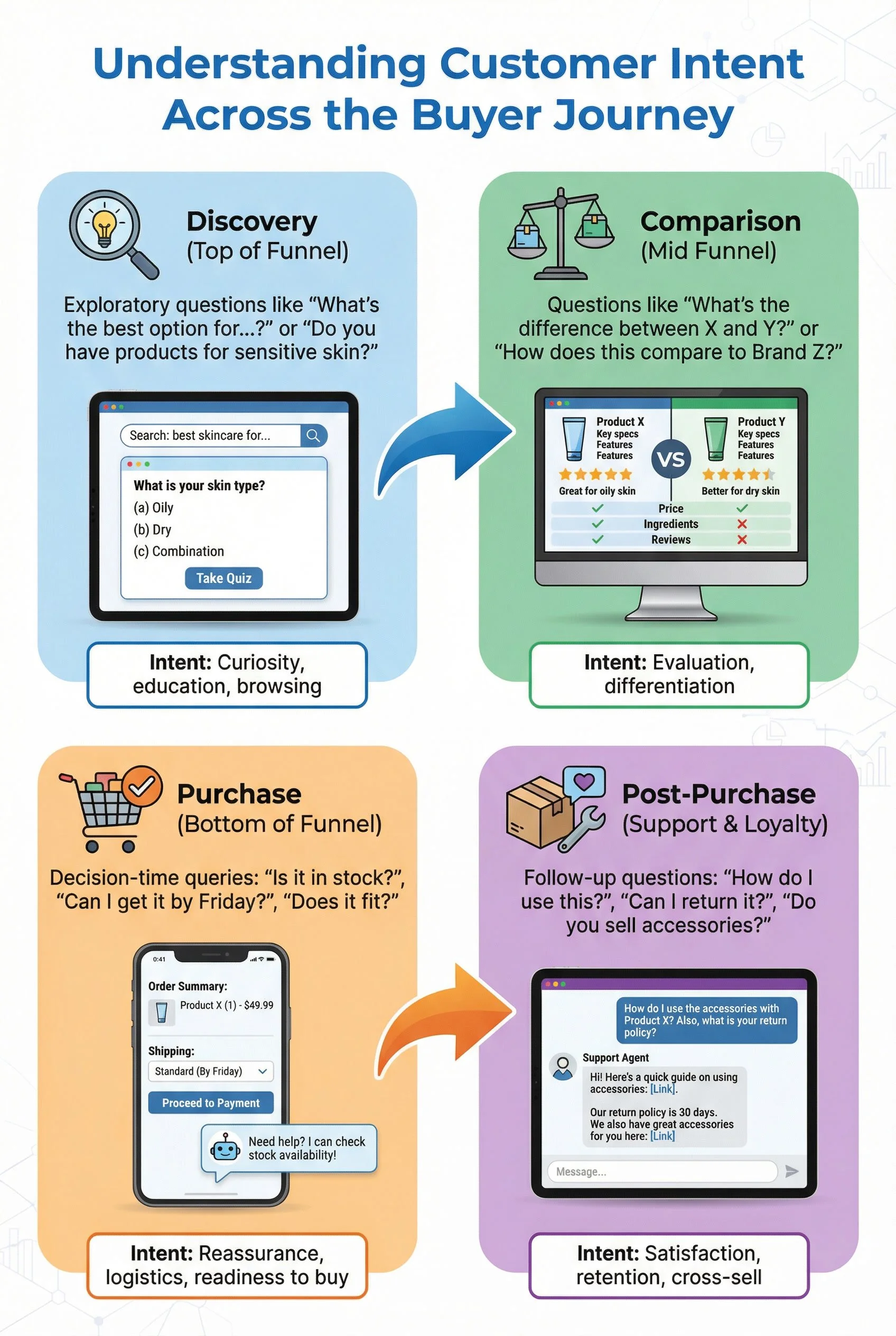

Understanding intent: discovery, comparison, purchase, and post-purchase. Not all questions are created equal. A crucial part of conversational commerce intelligence is deciphering the intent behind a question. Broadly, customer inquiries tend to fall into phases that mirror the buyer’s journey:

Discovery (Top of Funnel): These are early-stage questions from people exploring options or even just learning about their own needs. They often sound general. For example, “What’s the best sugar-free chocolate you offer?” or “Do you have any products for sensitive skin?” In the discovery phase, the customer may not even mention a specific product – they’re looking for ideas or solutions. The intent here is exploratory. A well-trained AI or agent recognizes that the customer might need education or broad recommendations, not a hard sell. It’s an opportunity to introduce products or content that the customer might not know about (think blog guides, buying guides, or interactive quizzes to help them narrow choices). Discovery questions are a signal that content marketing and informative dialogue are key. If you address these well, you keep the customer engaged in your ecosystem instead of bouncing off to Google or a competitor.

Comparison (Mid Funnel): As customers become more serious, their questions get more specific and comparison-oriented. They might be evaluating between choices, either within your lineup or against a competitor. These questions often include phrases like “difference between…,” “how does X compare to Y,” or “does it have X feature that [competing product] has?” For instance: “What’s the difference between your Model A and Model B blender?” or “Is this product as durable as Brand Y’s version?”. The intent here is to differentiate options and ensure they pick the right product for their needs. This is a pivotal moment to highlight your unique selling points or transparent facts. If the customer is comparing two of your products, it’s a chance to ask a bit about their priorities and steer them accordingly (e.g., “Model A has a larger capacity, while Model B is more compact – which feature matters more to you?”). If they’re comparing you with a competitor, answering frankly and helpfully can win respect. Brands often shy away from mentioning competitors, but a conversational approach lets you gently highlight advantages. For example, “Our camera and Competitor X’s both have 4K video; however, ours includes built-in stabilization, which is not present in the other.” These mid-funnel questions are laden with purchase intent – the customer is trying to remove the last obstacles to saying yes.

Purchase (Bottom of Funnel): Questions here indicate the customer is almost ready to buy. They’ve likely settled on a product and just need final reassurance or logistics info. They might ask about availability, delivery, pricing, or guarantees. Examples include: “Is it in stock and ready to ship?”, “Can I get it delivered by Friday?”, “Do you offer a warranty or return policy for this item?”, or “Will it fit [specific need]?”. The intent is confirmatory – they are double-checking that when they click “buy,” there will be no surprises. Brands must handle these with utmost clarity and confidence. This is the time to close the deal and eliminate any remaining doubt. Fast, accurate answers are critical because any friction can cause cart abandonment. An AI chatbot can be extremely useful here: if a user is on the checkout page lingering, a prompt like “Have a question about shipping or returns? Ask us!” can preempt abandonment. Common purchase-stage concerns include shipping cost and speed, product compatibility (e.g., “Will this ink cartridge work with my printer model X?”), and payment security. Make sure your conversational system is well-versed in these topics. Also, tone matters now – reassure the customer (“Yes, we can deliver by Friday, and you’ll get a tracking link as soon as it ships!”). The end of this stage should make the customer feel excited and safe to complete the purchase.

Post-Purchase (Customer Support & Beyond): The conversation doesn’t end at the sale. Post-purchase questions arise as customers start using the product or service. These include how-to questions (assembly or usage instructions), troubleshooting issues, and inquiries about returns or additional accessories. For instance: “How do I assemble this furniture?”, “I’m getting an error message, what do I do?”, “Can I buy replacement parts for this item?”. While these may be seen as support issues, they have a big impact on customer lifetime value and repeat sales. The intent here is either to achieve satisfaction with the purchase or to address a problem. Brands that excel in conversational commerce treat post-purchase interactions as another chance to build loyalty. Quickly helping a customer use their product effectively increases the likelihood of a positive review and a repeat purchase. If a customer asks “How do I clean this appliance safely?”, a fast, thorough answer not only prevents misuse (and potential returns) but also shows that the brand cares beyond the transaction. Moreover, analyzing post-purchase questions can feed back into product development and content creation. If dozens of customers ask how to assemble a particular toy, maybe the instruction manual or included documentation needs improvement, or a how-to video would be useful on the product page. If a pattern of the same troubleshooting question emerges, it could signal a quality control issue to fix. In the context of conversational intelligence, post-purchase queries are part of the full customer voice. They indicate what expectations need reset and what features or policies require clearer communication upfront. Importantly, they also present cross-sell opportunities. A customer asking how to use a stand mixer might be receptive to a gentle tip about “we also have a set of compatible mixing bowls that won’t scratch the surface.” Because the customer is already engaged with your answer, they’re likely to trust related recommendations – provided you genuinely address their question first.

Understanding intent is about reading between the lines. A well-designed Conversational Commerce Intelligence System uses AI to parse language and categorize intent automatically. For example, through natural language understanding (NLU), a system can often tell if a question is about features (comparison intent) versus availability (purchase intent) versus support. Some advanced chatbots explicitly ask clarifying questions: “Are you looking to understand which product suits you (discovery), or details about this specific product (detailed info)?”. By classifying questions by intent stage, brands can ensure the right content and approach is used. Early-stage questions might trigger a soft-sell, educational tone; late-stage questions a more conversion-focused tone; post-purchase questions a compassionate support tone.

Patterns in consumer inquiries. When you aggregate thousands of questions across channels, clear patterns emerge. Recognizing these patterns is like uncovering the FAQ of your customers’ minds, and it’s incredibly valuable for both marketing and product teams. Here are a few common patterns:

The Big Five (or Six) Topics: In many industries, consumer inquiries cluster around a handful of recurring themes. For retail products these often include Sizing/Fit, Compatibility, Ingredients/Materials, Usage Instructions, Shipping/Return Policies, and Comparisons/Alternatives. For example, a fashion retailer will repeatedly get questions about size and fit (“Is your sizing true to size or should I size up?”) and material (“Is this jacket made of real leather or faux?”). An electronics brand will see patterns around compatibility (“Will this work with iPhone 15?”) and technical specs (“How long does the battery last?”). By identifying your “big five” question categories, you can pre-emptively address them in product descriptions or canned chatbot responses. In fact, organizing FAQs by logical categories like Shipping, Returns, Product Details, Sizing, etc., is recommended to help consumers find answers quickly. It’s no coincidence that these categories often mirror the patterns in incoming questions.

Repetition of Exact Phrases: Often, customers use very similar (if not identical) wording when asking about a product. If one person asks “Does this TV come with a wall mount?”, chances are others will too. Brands often find that the same questions pop up again and again. This repetition is a strong signal of what information is not obvious or readily found in your current content. It might indicate a missing detail on the product page (in this example, maybe the page didn’t clearly state what’s in the box). Or it might reflect a common concern (people assume large TVs should include mounting hardware – if yours doesn’t, better make that clear and maybe suggest an accessory). By tracking frequently asked questions, you can create templates and knowledge articles to answer them efficiently, whether through a human agent or AI. Many helpdesk platforms will rank FAQs by usage; similarly, Amazon lists the “most helpful questions” which typically are the ones many people wondered about. Those are gold nuggets of insight.

Seasonal or Trend Spikes: Some questions show patterns over time. An example is seasonality: in the lead-up to holidays, a confectionery brand like Ferrero might see a spike in questions like “How long do these chocolates stay fresh? Can I buy now for Christmas?” or “Do you offer gift wrapping?”. In summer months, questions about chocolates melting during delivery might surge. Being attuned to these rhythms allows proactive communication. Ahead of common spikes, you can update your chatbot or site banner with “Hot weather shipping: We include cold packs to prevent melting!” – addressing questions before they’re even asked. Trends can also cause spikes: a viral social media post might lead to a flood of questions about a product’s availability or features that were highlighted. By monitoring question volume and topics, brands can catch these spikes early. A conversational intelligence platform might flag when a particular query suddenly jumps in frequency, signaling something in the market or media that the brand should respond to.

Product-Specific vs. General: Another pattern is the differentiation between specific and general questions. Specific questions name a product or model (“Does Nutella contain palm oil?” referring to a specific product) whereas general ones don’t (“Are any of your spreads palm-oil-free?”). Both are important. Specific questions often indicate the customer is already fairly deep in consideration of that exact item. General questions can indicate a customer’s broader concerns or values (in this case, an interest in palm-oil-free products). By analyzing both, a brand like Ferrero might realize there’s a general concern about ingredients (sustainability or health) that cuts across products – a cue to perhaps create a general communication about their ingredient sourcing or to introduce a new variant to meet that demand. Meanwhile, the specific Nutella question needs a specific answer (e.g., “Yes, it does contain palm oil, which we source sustainably – if you prefer a spread without it, our Product X is palm-oil-free”). The pattern of general vs specific inquiries can guide both marketing messaging (address the broad concerns) and product positioning (ensure each product’s common specifics are well explained).

Emotional Tone and Sentiment: While perhaps more subtle, patterns in the tone of questions can also be insightful. Are many questions phrased in an anxious or skeptical way (“Can I trust that this product is authentic on your site?”)? That might indicate trust issues in the market or with your brand’s perception. Or are they mostly enthusiastic (“I love this vanilla flavor – will you release a chocolate version soon?”)? That indicates a different kind of engagement (and perhaps product demand!). Sentiment analysis powered by AI can scan thousands of inquiries and tell you if a significant portion carry negative sentiment (frustration, confusion) versus positive. This can uncover pain points in the customer experience that aren’t explicit. For instance, if lots of questions are “Where is my order? It’s been 2 weeks!” you’ve got a potential delivery reliability issue even before looking at your shipping metrics. Patterns in sentiment act like an early warning system for customer satisfaction.

Turning data into dialogue means using these patterns to refine your approach continuously. A Conversational Commerce Intelligence System (CCIS) would not only compile the questions but analyze them for such patterns and feed the insights to various teams. Marketing can learn what to highlight in campaigns (if “safety” questions dominate, emphasize safety features in ads). E-commerce managers can optimize product pages (if lots of “what’s included in the box?” questions come in, add a clear content section for that). CX teams can prepare proactive communication – for example, sending a follow-up email or chatbot message to new customers answering the top 3 questions usually asked about that product, to preempt support tickets. Over time, the goal is that customers will find consistent, thorough answers wherever they look: on the product page, in the chatbot, or from a quick voice query. Patterns in inquiries essentially highlight the voice of the customer. Brands that listen carefully can transform scattered data points into a coherent dialogue, anticipating needs and speaking the customer’s language.

Transition: By gathering questions from every channel and deciphering what customers really mean at each stage, brands can turn raw data into actionable dialogue. However, there’s another side to the coin. Many brands still stumble because of blind spots in this conversational journey. They miss or mismanage critical details – often unknowingly – leading to frustrated customers and lost sales. In the next chapter, we shine a light on the pain points that brands often don’t see in their customer conversations, and how those gaps, inconsistencies, and trust-breakers can undermine even the best conversational commerce strategy.

Pain Points Brands Don’t See

Despite the best intentions to engage and inform, brands can fall short if they’re not looking at the customer conversation holistically. There are common pain points – often hidden in plain sight – that cause friction and erode trust. Identifying and addressing these is crucial for any brand manager or e-commerce professional aiming to fully leverage conversational commerce.

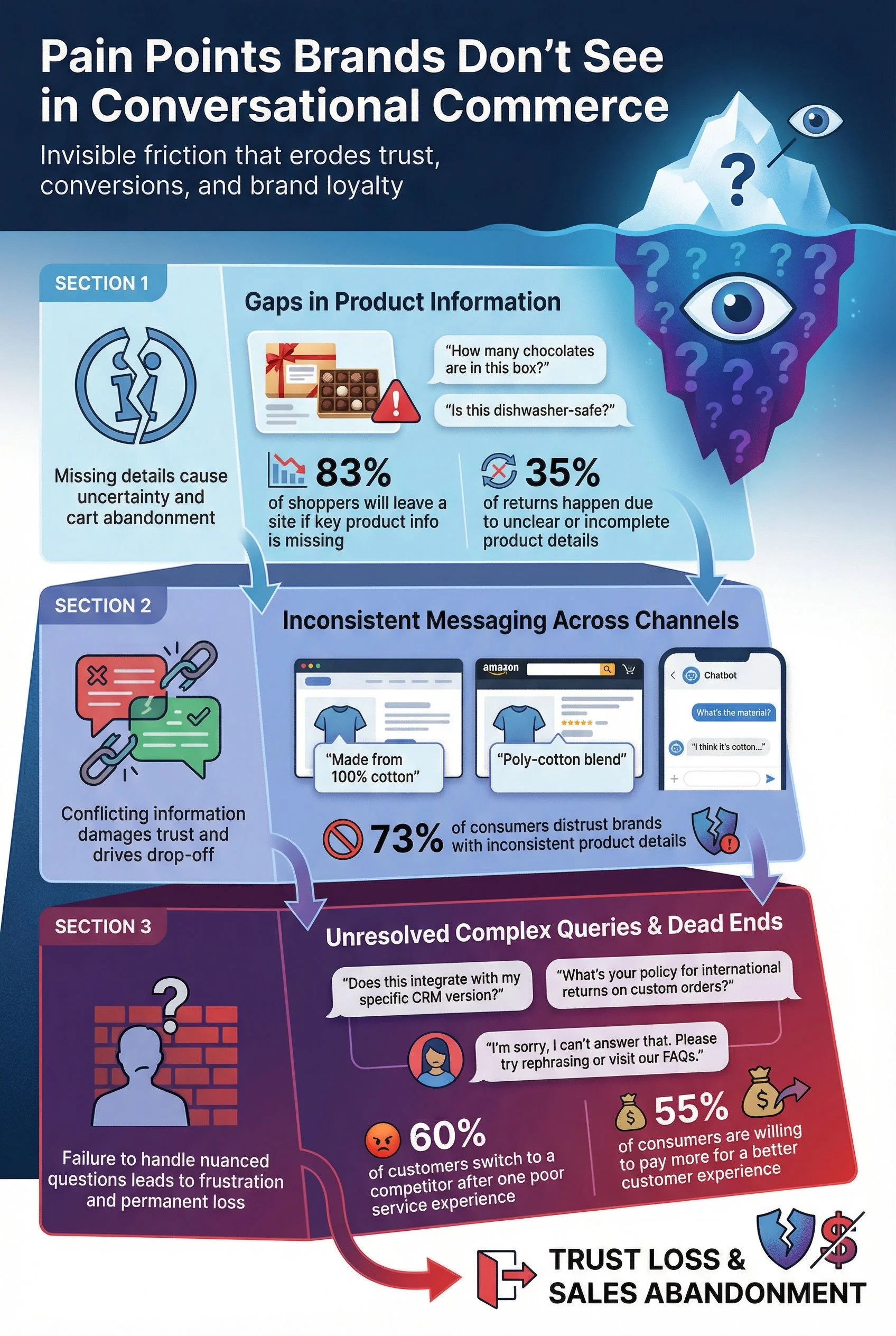

Gaps in product information. One of the most glaring pain points is missing or insufficient product information. This is the digital equivalent of a customer picking up an item in a store and not finding a price tag or ingredient list – a frustrating dead end. Online, when a detail is omitted, customers will either ask about it or, worse, make assumptions (which could be incorrect or lead them to bail out). Gaps might include technical specifications, size dimensions, compatibility notes, nutritional facts, assembly instructions – basically any detail that a potential buyer deems important. Often, brands assume certain things are understood or not worth listing, but real customer questions prove otherwise. For example, Ferrero could list a chocolate gift box without explicitly stating how many pieces are inside; you can bet multiple customers will inquire, “How many chocolates come in this box?” If that answer isn’t readily available, it becomes a hurdle to purchase. The cost of missing info is very real: 83% of global shoppers said they would abandon an e-commerce site if it lacks sufficient product information. And half of shoppers in a survey reported leaving or not completing a purchase in the last six months specifically because they couldn’t find the info they needed. That’s a huge chunk of potential revenue lost simply for not telling the customer what they want to know.

Gaps in information also lead to post-purchase problems. If a customer buys based on incomplete information, they may end up dissatisfied – resulting in returns or negative reviews. In fact, 35% of consumers have returned a product because it didn’t meet expectations set by the content they saw before purchase. That often circles back to missing or unclear info (for instance, the online description didn’t mention the blender was not dishwasher-safe, and the customer, assuming it was, now feels misled). Every return or complaint is essentially a customer question that wasn’t answered pre-purchase. The lesson for brands: comb through your product content and proactively fill those gaps. Leverage the compiled list of customer questions as a checklist – if something has been asked more than a couple of times, it probably belongs in the product description or specs table. Additionally, consider content beyond text: sometimes a simple diagram or image (like a size chart or a 360-degree product view) can preempt dozens of questions. Rich content pays off because 83% of shoppers will switch to a competitor’s site if the information on yours is incomplete. In the age of endless options, the site that “answers everything” wins the customer.

Inconsistent messaging across channels. Another invisible pain point is inconsistency. This occurs when a brand’s answer to a given question varies depending on where the customer looks or who they talk to. Perhaps the brand website says one thing, a customer service rep says another on the phone, and an answer on a retailer’s site says yet another. Such discrepancies can severely damage trust. For example, suppose Ferrero’s official site FAQ says “Our cocoa is 100% sustainably sourced,” but on a retailer’s Q&A section someone from the brand (or another customer) gave a less confident answer like “I think it’s sustainable, not sure.” A savvy customer will notice the disconnect and start doubting the brand’s transparency. Or consider pricing and promotions: if your Instagram ad promises a discount that isn’t reflected on your web store, you’ll field angry questions. Inconsistent product data is often a result of silos within an organization – each department or channel working from a different source of truth, leading to contradictions. This isn’t just hypothetical: a case study described a company launching a product across 15 channels in multiple countries, only to find inconsistent product specifications in different places led to massive confusion – the outcome was over 2,000 product returns and about $500,000 in lost revenue and emergency fixes. That’s an extreme example, but it illustrates the stakes. If one site lists a product as made of “100% cotton” and another lists it as “poly-cotton blend,” customers will either pepper you with questions for clarification or avoid the purchase entirely, fearing one of the sources is wrong.

Inconsistent messaging is a silent conversion killer. Shoppers might not always take the time to ask, “Hey, which source is correct?” – many will simply walk away because the brand appears unreliable. According to research, 73% of consumers say they’d think less of a brand that has incomplete or inaccurate information about its products online. That’s a reputation hit that can be hard to mend. Moreover, inconsistency forces your frontline teams to do damage control – support agents end up apologizing for “the confusion” and rectifying misinformation, which is time they could spend selling or delighting customers instead. To solve this, brands need to aim for a single source of truth. This is where a robust product information management (PIM) system or a CCIS comes in, ensuring that every channel – website, app, Amazon listing, PDF catalog, chatbot – is drawing from the same updated data pool. As one expert quipped, PIM turns “scattered data into centralized control,” letting you distribute perfect product information to every channel automatically. When you update a spec or policy in the central system, it should propagate everywhere. The payoff is huge: consistency means a customer hears the same answer no matter how they ask the question. That uniformity breeds confidence. On the flip side, “channel chaos” where product descriptions differ on your site vs. Amazon vs. retailer listings, visibly damages trust. Customers start to wonder if they’re even looking at the same item, or if one of the sources is outdated. Even worse, outdated info lingering on some channel can lead to customer service blowback – imagine a promo that ended, but one page still lists it, leading to an angry “The website said 20% off!” message. Internally, achieving consistency requires coordination and often investment in better tools. But considering that inaccurate or inconsistent product content not only frustrates shoppers but also slows down sales expansion (45% of businesses take over 6 months to update content for new channels, often due to disjointed processes), it’s a worthy investment. Your brand’s credibility is on the line each time you give conflicting answers.

Conversion and trust loss from unanswered or mismanaged questions. Finally, perhaps the most critical pain point is the unseen opportunity cost when customer conversations are not handled optimally. Every unanswered question or delayed response is a potential sale lost and a bit of trust chipped away. In the realm of conversational commerce, speed and accuracy matter tremendously. Consumers now expect answers nearly instantly – more than half expect a response to their online question within 24 hours, and 21% expect it within 4 hours. If a brand can’t meet these expectations, customers move on. Think of a social media DM that goes unread for days, or a forum question where the official rep never replies – it sends a signal that the brand isn’t listening, or worse, doesn’t care. That’s a recipe for conversion loss, especially among today’s impatient digital shoppers.

Even when answers are given, how they are given affects trust. A curt, templated answer that doesn’t really address the heart of the question can leave a customer just as unsatisfied as no answer at all. Similarly, if a brand representative provides incorrect or misleading information (perhaps by accident, due to not having the latest details), trust takes a hit. Trust is hard-won and easily lost in digital commerce. As mentioned earlier, consumers are quick to doubt a brand if they encounter inconsistent or missing info. On the flip side, positive, trust-building interactions have measurable impacts. For instance, when companies offer excellent customer service (like promptly and helpfully answering questions), 93% of customers are more likely to make repeat purchases. In a very real sense, answering questions thoroughly not only can win the immediate sale but also paves the way for loyalty.

One hidden pitfall is assuming that if customers really want a product, they will overcome obstacles to get answers. In reality, the opposite is true in a competitive market. The easier you make it for customers to get answers, the more likely they convert with you versus a competitor. A telling statistic from PowerReviews found that when shoppers engage with Q&A content, conversion rates significantly increase – implying that those questions and answers are eliminating doubts that would have otherwise stalled the sale. Moreover, a lack of Q&A content can actively deter purchase: 1 in 4 consumers may decline to buy a product if they can’t find any Q&A about it. Younger shoppers like Gen Z are even more wary – a third of Gen Z said no Q&A on a product page makes them less likely to buy. These consumers have grown up in an era of interactive information; a static page that doesn’t address real user queries just doesn’t cut it.

Mismanaged questions – such as those answered incorrectly or too generically – can also spread misinformation. If a fellow customer provides a wrong answer on a forum and the brand doesn’t chime in to correct it, other readers will be misled. If a chatbot provides an irrelevant answer due to poor understanding, the customer may give up on the channel entirely (“Ugh, this bot doesn’t get me. I’ll just leave”). Therefore, ensuring quality control in answers is key. AI can help here: by analyzing the content of answers given (by bots or agents) and cross-verifying with the knowledge base, brands can catch inconsistencies or errors. Training AI with a strong dose of the brand’s product data and policies reduces the chance of off-base answers. And when the AI doesn’t know, it should be designed to escalate to a human rather than guess – a transparent “Let me connect you to a specialist” maintains more trust than an incorrect confident answer.

A special mention should be made about tone and empathy. In conversational commerce, the style of interaction influences whether the customer feels confident to buy. A pain point brands sometimes don’t see is when their tone doesn’t match customer expectations. For example, an overly informal chatbot for a luxury brand might make customers question the brand’s sophistication, or an overly formal, scripted response for a fun, youthful brand might feel cold. Ensuring that the brand voice is consistent and appropriate across automated and human answers is vital. When done right, even an AI-driven conversation can “feel human” and on-brand, which reinforces trust. When done poorly, it jars the customer and again sows doubt (“Am I really chatting with Brand X, or is this some scam?”).

In summary, unanswered questions, inconsistent answers, or slow responses all create friction that can silently undermine conversion rates and lifetime customer value. The pain point for many organizations is that they don’t have visibility into this attrition. They see the abandonment in analytics, or the lower conversion on certain products, but might not connect it to the QA experience. This is why building a feedback loop is essential – linking things like “we added answers to 50 common questions and saw conversion on those products rise” or “since we unified our info and started responding in under an hour on social, customer satisfaction scores went up.” What gets measured gets managed. Thus, bringing these conversational metrics into the light is key. It could be as straightforward as tracking how many questions are left unanswered each week, or the average response time on each channel, and setting goals to improve them. Each improvement likely correlates with better sales and loyalty metrics.

To illustrate, consider a brand that revamped its approach: KÜHL, an outdoor apparel company, worried that using AI for customer queries might harm their authentic brand voice. But after implementing an AI assistant (and carefully training it to uphold their communication style), they found it resolved 59% of email inquiries on its own while keeping a 75% customer satisfaction rate. More impressively, by freeing up human agents from repetitive questions, those agents could focus on higher-value conversations – leading to a 120% increase in per-call revenue in some cases. This shows that when you handle the Q&A flow efficiently and accurately, not only do you prevent conversion loss, you can actually boost sales per interaction. Similarly, Rothy’s (a footwear brand) used conversational commerce tools to scale their personalized support during growth, and they saw that over 20% of customers who engaged with an agent ended up making a purchase, while maintaining 93% satisfaction. These real-world examples underscore how addressing customer questions promptly and effectively turns customer service from a cost center into a revenue engine.

In conclusion, the unseen pain points – missing info, inconsistent answers, and slow or poor responses – can silently sabotage your conversational commerce efforts. But by recognizing and addressing them, brands can transform the customer Q&A experience into a competitive advantage. A well-implemented conversational commerce intelligence system ensures that wherever a customer asks a question, they get a timely, correct, and brand-consistent answer. That level of responsiveness builds trust with consumers, and trust translates into conversion and loyalty. Brands that illuminate and fix these blind spots will not only prevent the loss of sales that slip through the cracks, but also strengthen their reputation as transparent, customer-centric businesses. And that reputational gain is hard to overstate – in a world where consumers have endless options, they will stick with and advocate for the brands that consistently answer them and guide them with confidence.

By understanding the rise of conversational commerce, analyzing the data within customer dialogues, and addressing the often-overlooked pain points, brands can fully unlock the power of conversational commerce intelligence. A customer question is not a distraction or a cost – it’s a signal of intent and a chance to engage. Those companies that treat every question as an opportunity to build trust and provide value will drive more sales and foster deeper loyalty in the age of the empowered, conversation-loving consumer.