Business Resilience in the age of AI - from Product Provider to a Platform Orchestrator, with MCP

When I speak to founders and business leaders, they’re obsessed with the product. The feature. The app. The widget.

But here’s the uncomfortable truth: in 2025, products don’t matter as much as you think they do.

AI has killed the moat of product differentiation. Any feature you release today can be replicated in days — sometimes hours — by a competitor with a good prompt or a clever developer.

So if the product isn’t the moat… what is?

The answer is ecosystems.

Think about nature. A tree on its own is vulnerable. One storm, and it’s gone.

But a forest? A forest is resilient because it’s interconnected. Roots, fungi, nutrients — give and take, constant flow. That’s what makes it thrive.

Businesses are the same.

Apple isn’t valuable just because of the iPhone. The real moat is the App Store, iCloud, AirPods, the developer ecosystem. Millions of people building apps, accessories, services — all tied back to Apple. That’s why Apple can’t be touched.

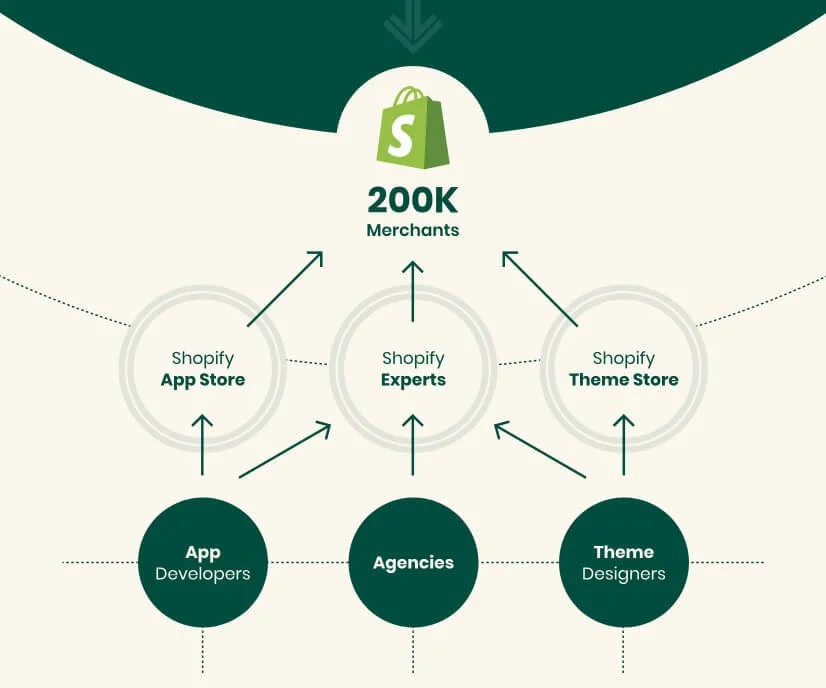

Shopify? Their merchants don’t stay because Shopify has a nice UI. They stay because there are thousands of apps, partners, and agencies building on Shopify. The ecosystem creates lock-in. It creates resilience.

Amazon? Same story. Over 60% of their sales come from third-party sellers. The sellers are the ecosystem. Amazon doesn’t just sell products — they orchestrate commerce.

Here’s the point: the companies that win today aren’t products. They’re platforms. They’ve built ecosystems of developers, partners, and customers who can’t live without them.

And here’s the kicker — ecosystems aren’t accidents. They’re built deliberately.

They require three things:

Openings: APIs, SDKs, marketplaces — ways for others to plug in.

Incentives: Revenue sharing, distribution, visibility. Why should people build on you?

Governance: Rules that make the ecosystem fair, trusted, and sustainable.

The mindset shift is this: stop thinking about what you can build, and start thinking about what you can enable others to build.

Because resilience in business doesn’t come from one killer feature. It comes from being the hub of a network so valuable, so interdependent, that no one can ignore you — and no one can replace you.

That’s the power of ecosystems. That’s the future of defensibility.

TABLE OF CONTENT

I. Introduction

Business Resilience in the Age of AI

Lessons from Nature

II. Tech Architecture

Application Programming Interface (APIs)

Software Developer Kits (SDKs)

Model Context Protocol (MCP)

III. HR Architecture

Founder Mindset Shift

Organisation Chart

IV. Legal Architecture

IP Frameworks

Data Rights & Privacy

Partner Governance

Emerging AI Legal Needs

Competition Law

V. Financial Architecture

Capital Requirements

Payment Mechanisms

Ecosystem Metrics

AI-Native Financial Flows

Exit Scenarios

VII. The Ecosystem Roadmap

Stage 1: Isolated Product

Stage 2: Connected Product

Stage 3: Platform Emergence

Stage 4: Ecosystem Hub

Stage 5: Orchestrator

VIII. Investor Guidance

Investment Thesis

Top Startups

The Ecosystem Strength Index

Predictions

What Businesses Can Learn from Forests About Building Ecosystems

Lessons from the Forest: How Trees Teach Us About Resilient Ecosystems

When we think about forests, it is easy to see them as a collection of individual trees standing side by side. But ecologists have shown that a forest is not simply a crowd of organisms competing for sunlight and soil. Beneath the surface, there is an extraordinary network of connection and cooperation. Trees do not just grow alone; they communicate, share, and support one another through a hidden architecture of roots and fungi. It is this system of give and take that makes a forest resilient.

The Underground Network

Under the forest floor lies an intricate web of roots intertwined with mycorrhizal fungi. These fungi form symbiotic relationships with trees, attaching to their roots and extending the reach of the root system far beyond what each tree could achieve alone. Through this network—sometimes called the “wood wide web”—trees exchange not only nutrients like nitrogen, phosphorus, and carbon, but also chemical and electrical signals.

A tree under attack by insects, for instance, can release warning signals through its roots and fungal connections, prompting neighboring trees to boost their defenses. In times of abundance, large, established trees channel resources to younger or weaker ones. This hidden system ensures that no tree is entirely on its own. The health of the whole forest depends on this constant communication.

Supporting the Next Generation

Forests also show us how established members nurture newcomers. Research has revealed that so-called “mother trees”—the largest, oldest individuals in a forest—actively send nutrients through the mycorrhizal network to young seedlings struggling in the shade. Without this support, many seedlings would not survive long enough to reach the canopy.

This is not altruism in the human sense. The survival of seedlings ensures the continuity of the forest itself. By investing in the next generation, mature trees are also safeguarding their own long-term future. It is a living example of resilience through interdependence.

Give and Take as a Survival Strategy

In the forest, cooperation does not erase competition. Trees still compete for sunlight, water, and space. Yet the forest thrives because it balances both dynamics. The sharing of resources, the early warning signals, and the mutual support ensure that the system can withstand storms, fires, pests, and other shocks.

A forest composed of trees that only competed—never cooperating—would be fragile, easily destabilized. Instead, the interconnected web of roots and fungi creates redundancy, diversity, and adaptability. In ecological terms, this is resilience: the ability to endure disturbance and still regenerate.

Applying the Lessons to Business

A forest is not just a collection of trees standing in the same place. Beneath the surface, trees are connected through their roots and networks of mycorrhizal fungi. These underground systems allow them to exchange nutrients, send warning signals, and even support new seedlings. The resilience of the forest does not come from any single tree’s strength, but from the interconnected web of relationships that allows the whole ecosystem to endure.

Businesses can learn several lessons from this natural model of resilience.

Interconnection Strengthens the Whole

In a forest, a tree draws from the network when it needs help and contributes when it has abundance. In business, this principle applies to partnerships, integrations, and platforms. Companies that open themselves to connections—through APIs, marketplaces, or collaborative networks—create resilience by embedding themselves into a broader system. When one element struggles, the others compensate; when one grows, the others benefit.

Support the Next Generation

Old growth trees support seedlings because the survival of new life ensures the continuity of the forest. Similarly, businesses that invest in startups, developers, or smaller partners strengthen their ecosystem. Amazon’s marketplace, Apple’s App Store, and Shopify’s partner network all demonstrate how nurturing participants can multiply value and reinforce long-term stability.

Communication Creates Adaptability

Trees warn one another of pests and disease. Businesses also need channels for information to flow across their networks. Ecosystem-oriented companies are transparent with partners, share data standards, and enable feedback loops. This constant communication allows the entire system to adapt quickly to changes in markets or technology.

Give and Take Builds Resilience

Competition still exists in a forest, as trees reach for sunlight, but cooperation underpins survival. In business, pure competition produces fragility. A resilient ecosystem combines rivalry with collaboration: companies compete on offerings but share infrastructure, standards, and access points that raise the value of the whole system.

Ecosystem Resilience Outlasts Product Features

A tree standing alone can be felled by one storm. A tree in a forest is buffered by its neighbors. In the same way, a company that depends only on the uniqueness of its product is vulnerable to imitation, especially in the age of AI where features can be replicated quickly. But companies embedded in ecosystems—where customers, developers, and partners all depend on them—are much harder to dislodge.

Tech Giants’ Ecosystem Strategies

In the modern tech industry, success often hinges on building an ecosystem – a self-reinforcing network of products, developers, and users that drives growth and loyalty. Below, we explore how several leading companies have built powerful ecosystems, why those ecosystems matter, and their defensibility (i.e. how these ecosystems serve as moats against competitors). For each company, we also provide a timeline of key milestones in the evolution of its ecosystem.

Apple

Ecosystem play: Devices, iOS, and the App Store.

Why it matters: The App Store transformed Apple from a hardware company into a platform with millions of third-party apps and services. Apple’s integration of hardware, software, and services (AirPods, iCloud, Apple Pay, etc.) ensures customers rarely leave the ecosystem once they enter.

Defensibility: Competitors can replicate devices, but not the vast developer and user ecosystem tied to iOS.

Microsoft

Ecosystem play: Windows, Office 365, Azure Cloud, GitHub, LinkedIn.

Why it matters: Microsoft integrates across consumer, enterprise, and developer communities. Azure’s marketplace hosts thousands of partner apps. GitHub anchors developer loyalty, while LinkedIn gives Microsoft unique professional network data.

Defensibility: Deep entanglement with enterprise IT and developer workflows makes Microsoft indispensable.

Amazon

Ecosystem play: Marketplace (third-party sellers), AWS, Alexa ecosystem.

Why it matters: Over 60% of Amazon’s retail sales now come from independent third-party sellers. AWS has created an entire ecosystem of SaaS providers, startups, and consultants building on its infrastructure.

Defensibility: Amazon doesn’t just sell products; it orchestrates commerce and cloud ecosystems that millions of businesses rely on.

Ecosystem play: Android, Google Play Store, Google Ads, YouTube, Google Cloud.

Why it matters: Android powers billions of devices, and the Play Store supports millions of apps. Google Ads and YouTube provide distribution channels for creators and businesses, creating feedback loops across its platforms.

Defensibility: Google dominates by being the connective tissue between consumers, advertisers, and developers.

Meta (Facebook)

Ecosystem play: Facebook, Instagram, WhatsApp, and Messenger.

Why it matters: Meta’s platforms are interconnected, sharing data and advertising infrastructure. Its developer ecosystem (APIs, ad tech, integrations) allows businesses to build on its networks.

Defensibility: The scale of its social graph and the breadth of its advertising ecosystem make Meta difficult to replace.

Shopify

Ecosystem play: App Store, Shopify Plus partners, fulfillment network.

Why it matters: Shopify’s app marketplace and partner network generated more revenue for third parties than Shopify itself. This symbiotic relationship keeps merchants, developers, and agencies invested.

Defensibility: Merchants choose Shopify because of the extensibility of its ecosystem, not just its core product.

Salesforce

Ecosystem play: AppExchange, Trailblazer community, partner consultants.

Why it matters: Salesforce turned CRM into a platform others could extend. Thousands of apps, integrations, and a global network of consultants power its ecosystem.

Defensibility: Customers who embed Salesforce deeply into their workflows with third-party apps are unlikely to switch.

Nvidia

Ecosystem play: GPUs, CUDA, developer tools, partnerships with cloud and AI labs.

Why it matters: Nvidia invested early in CUDA, which became the dominant programming model for GPU computing. Its ecosystem includes researchers, developers, and enterprises building AI models on Nvidia infrastructure.

Defensibility: The breadth of its developer ecosystem ensures competitors struggle to displace it, even with cheaper hardware.

n8n (and similar open-source platforms)

Ecosystem play: Community-driven workflows and integrations.

Why it matters: n8n encourages developers to contribute nodes and workflows, accelerating its integration library faster than any internal team could.

Defensibility: A global, participatory community creates resilience and innovation velocity.

Read More -

https://www.francescatabor.com/articles/2025/8/17/tech-giants-ecosystem-strategies

Founders Driving Ecosystems

A founder who wants to build an ecosystem must think less like a product CEO and more like a network architect. Their success depends on creating conditions for others to thrive, because their platform’s resilience will come from the forest around it, not the single tree they planted.

Test Founder’s Ecosystem Mindset

Investors who only ask “what’s your product?” miss whether a company can actually become resilient through ecosystem effects. To test if founders have that mindset, investors need to probe beyond features into platform & network thinking.

1. Product & Offering

How does your product enable others to build on top of it?

What parts of your tech are modular, extensible, or API-driven?

Do you see your company as a product, platform, or future infrastructure layer? Why?

2. Integrations & Interoperability

Which integrations matter most to your customers today?

How are you prioritizing interoperability with other platforms, standards, or protocols (e.g., MCP)?

What % of your roadmap is dedicated to making your product easier for others to plug into?

3. Community & Developers

Do you have developers, partners, or users creating value beyond what your team builds?

How do you support community contributions (open source, SDKs, hackathons)?

What would you do if 10x more people wanted to extend your product tomorrow?

4. Partnerships & Ecosystem Positioning

Who are your most important partners today? Who do you want as future partners?

How do you co-create value with partners instead of just reselling each other’s products?

Where do you sit in the value chain — isolated, connected, hub, or orchestrator?

5. M&A, Standards, & Long-Term Play

If you had capital tomorrow, which companies would you acquire to strengthen your ecosystem?

Do you see yourself participating in setting industry standards (protocols, schemas, data sharing)?

What would make your ecosystem resilient if someone cloned your core product?

6. Metrics & Success Signals

Beyond revenue, what metrics do you track to measure ecosystem strength (integrations, partners, apps built, community size)?

What % of revenue or usage comes from ecosystem participants (vs direct product usage)?

How do you balance control vs openness in your platform?

Red Flags (No Ecosystem Mindset)

Founders only talk about “our product” and “our features.”

No APIs, SDKs, or integrations planned.

View community as support forum, not co-creators.

Competitive mindset = “we’ll beat everyone” instead of “we’ll become the hub others orbit.”

Green Flags (Ecosystem Mindset)

Talk about platform vision (“we want to be the backbone others build on”).

Roadmap includes APIs, MCP, SDKs, open standards.

Explicit plans for hackathons, marketplaces, or developer incentives.

Revenue vision includes ecosystem monetization (apps, marketplace fees, API access).

Why MCP is Key

MCP becomes the litmus test for whether a founder thinks ecosystem-first:

Are they MCP-ready? → They understand interoperability.

Do they talk about feeding their data/tools into AI assistants? → They understand distribution.

Are they preparing to let partners build on top of them? → They understand network effects.

Types of Founder Profiles

1. High Openness (Visionary / Explorer)

Mindset: Creative, experimental, embraces new ideas.

Approach to Ecosystem: Pushes for open standards, interoperability (APIs, MCP, open-source). Attracts developers with bold, future-facing visions (e.g., Elon Musk with Tesla’s open patents). Likely to foster communities of innovators and early adopters.

Strengths: Inspires participation, good at evangelizing new paradigms.

Risks: May neglect governance and structure, leading to chaotic ecosystems.

Best Practice: Balance openness with clear rules, incentives, and long-term commitments.

2. High Conscientiousness (Architect / Planner)

Mindset: Disciplined, structured, focused on long-term execution.

Approach to Ecosystem: Designs detailed partner frameworks, certification programs, revenue-share agreements. Prioritizes trust, compliance, and reliability (e.g., Microsoft with Azure + partner network). Builds ecosystems slowly but sustainably, ensuring resilience.

Strengths: Creates strong governance and standards, avoids chaos.

Risks: May move too slowly, missing first-mover advantage.

Best Practice: Pair with high-openness partners to balance vision and execution.

3. High Extraversion (Connector / Evangelist)

Mindset: Outgoing, persuasive, thrives on networking.

Approach to Ecosystem: Focus on community, hackathons, conferences, and partnerships. Attracts momentum by sheer energy and visibility (e.g., Marc Andreessen rallying around “software eats the world”). Builds ecosystems through relationships rather than just technology.

Strengths: Quickly scales participation, galvanizes attention, great at securing high-profile partnerships.

Risks: May overpromise or struggle to sustain technical depth.

Best Practice: Anchor community excitement with solid technical infrastructure and clear governance.

4. High Agreeableness (Diplomat / Bridge-Builder)

Mindset: Cooperative, empathetic, values harmony.

Approach to Ecosystem: Builds trust-based networks, collaborative partnerships, joint ventures. Creates win-win revenue models (e.g., Shopify removing app commissions on first $1M). Excellent at nurturing developer and partner loyalty.

Strengths: Strong partner retention, high trust and goodwill.

Risks: May avoid tough governance decisions; ecosystems risk being exploited without rules.

Best Practice: Balance diplomacy with firmness on standards and compliance.

5. High Neuroticism (Risk-Aware / Controller)

Mindset: Sensitive to risks, prefers control and certainty.

Approach to Ecosystem: Tends to favor closed ecosystems with tight rules (e.g., Apple’s App Store review process). Implements strong compliance, quality control, and defensive legal frameworks. Protects brand reputation above all.

Strengths: Builds trusted, high-quality ecosystems with consistent user experience.

Risks: Can stifle innovation and frustrate developers/partners.

Best Practice: Allow controlled “zones of openness” to foster innovation while maintaining risk management.

HR Plan

Roles & Responsibilities

Executive Leadership

Chief Executive Officer (CEO): Sets the vision for shifting from product to platform, communicates ecosystem strategy to investors and customers, and allocates resources.

Chief Strategy Officer (CSO): Identifies where ecosystem building creates defensibility, ensures alignment with long-term growth.

Chief Operating Officer (COO): Designs the operational backbone to support partners, integrations, and marketplaces.

Product & Technology

Chief Product Officer (CPO): Shapes the product roadmap to support APIs, SDKs, and developer enablement.

VP/Director of Product Platform: Owns the platform layer (APIs, app marketplace, partner integrations).

Chief Technology Officer (CTO): Ensures technical architecture supports openness, interoperability, and scalability.

Ecosystem Product Managers: Manage APIs, connectors, developer experience, and integration frameworks.

Partnerships & Business Development

Chief Business Development Officer (CBDO): Leads strategic alliances and industry partnerships.

Head of Partnerships / Partner Managers: Recruit, onboard, and grow partner relationships (integrators, resellers, technology partners).

Ecosystem Development Lead: Focused on co-creation opportunities with startups, ISVs (independent software vendors), and enterprise partners.

Community & Developer Relations

Head of Developer Relations (DevRel): Builds relationships with developers, evangelizes APIs and SDKs, runs hackathons.

Community Managers: Foster engagement among users, partners, and developers through forums, events, and content.

Technical Evangelists: Showcase what can be built on the platform, lowering barriers for adoption.

Marketing & Ecosystem Growth

Chief Marketing Officer (CMO): Frames the narrative around the platform and ecosystem, not just the product.

Ecosystem Marketing Manager: Promotes marketplace apps, partner success stories, and ecosystem impact.

Customer Success Managers: Ensure customers adopt ecosystem features (integrations, apps), feeding back insights into product and partner strategy.

Corporate Development & Investment

Corporate Development / M&A Team: Identifies acquisitions that strengthen the ecosystem (e.g., Shopify buying logistics startups to support merchants).

Venture / Investment Arm: Invests in startups building on the platform to accelerate ecosystem growth.

Governance & Standards

Legal & Compliance Teams: Define rules for app marketplaces, partner certifications, and data-sharing standards.

Ecosystem Governance Board (if mature): Cross-functional group that oversees partner policies, ecosystem incentives, and risk management.

In practice:

Startups: CEO + Head of Product + Head of Partnerships often lead ecosystem-building.

Scale-ups: Dedicated roles emerge (Ecosystem PMs, DevRel, Partner Marketing).

Enterprises: Ecosystem strategy sits across C-suite, partnerships, product, and corporate development.

The Culture

1. From Ownership to Orchestration

Product mindset: “We build everything ourselves.”

Ecosystem mindset: “We create the conditions for others to build with us.”

Founders must see themselves not as product owners, but as orchestrators of value across many players.

2. From Competition to Co-opetition

Recognize that partners may also be competitors.

Build structures where rivals can plug in without threatening the core.

Example: Apple allows competing apps in the App Store, but keeps control over distribution and monetization.

3. From Control to Trust & Governance

Ecosystem leaders set rules of the game, not micromanagement.

They create governance frameworks (fair revenue sharing, app reviews, certification), so participants trust the platform.

Founder mindset: “We win when people trust us to set a fair stage.”

4. From Inside-Out to Outside-In Innovation

Accept that the best ideas come from outside.

Encourage developers, startups, and partners to innovate faster than you could internally.

Founder mindset: curiosity over control — listening to community signals, not dictating everything.

5. From Linear Growth to Network Effects

Products grow linearly with each sale. Ecosystems grow exponentially as more participants join.

Founder mindset: willing to invest before short-term profit, to reach network-effect tipping points.

Example: Shopify removed commissions on the first $1M earned by developers, to jumpstart its app economy.

6. From Customer-Centric to Multi-Sided Thinking

Ecosystem builders think in three dimensions: customers, partners, and developers.

Founder mindset: “I serve multiple groups and create value for all, not just my end customer.”

This requires balancing incentives across the ecosystem, not optimizing for one stakeholder.

7. From Fortress to Open Standards

Ecosystems thrive when built on interoperability, not closed walls.

Culturally, this means embracing APIs, open source, and now protocols like MCP.

Founder mindset: belief that openness multiplies resilience, even if it reduces short-term control.

Legal Plan

1. Intellectual Property (IP) Framework

APIs & SDKs: Define licensing terms (permissive, commercial, open source).

Developer IP: Clarify ownership of apps, plugins, or integrations built by third parties.

Branding: Rules for use of trademarks, logos, and marketing materials.

Patents: Defensive filings around interoperability tech or marketplace structures.

Typical Agreements:

Developer Terms of Use

API License Agreement

SDK License Agreement

Trademark/Brand Usage Guidelines

2. Data Rights & Privacy

Data Sharing: Clarify ownership of data passed through APIs or protocols (who owns raw vs. derived data).

Compliance: Must align with GDPR, CCPA, HIPAA (if health data), financial data rules, etc.

Consent: Explicit agreements on how end-user data can be accessed, stored, and shared.

Security: Contracts should set encryption, retention, and breach notification obligations.

Typical Agreements:

Data Processing Agreement (DPA)

Joint Controller Agreements (where parties share data responsibility)

Data Licensing Agreements

3. Partner Governance & Liability

App Marketplace Rules: Terms of service governing what apps can be listed, revenue share, quality standards.

Partner Certification: Agreements defining partner responsibilities, liability, and compliance checks.

Indemnities: Contracts must allocate responsibility if an app/integration causes harm.

Typical Agreements:

Partner Program Terms

Marketplace Developer Agreement

Technology Partner Agreement

Reseller/Distributor Agreement

4. Commercial & Revenue Sharing

Revenue Models: Define commission splits (e.g., Apple 30% App Store cut).

Payment Flows: Who collects end-user payments, how funds are distributed.

Liability: Clarify refunds, chargebacks, and fraud responsibilities.

Typical Agreements:

Revenue Share Agreement

Affiliate/Referral Agreement

Joint Venture Agreement (for deeper partnerships)

5. AI Transparency & Attribution

Companies may be required to disclose when AI-generated outputs rely on third-party data (EU AI Act, US AI policy trends).

Ecosystem contracts will need clauses covering data attribution, provenance, and liability for misinformation.

6. AI Safety & Compliance

EU AI Act: High-risk AI systems must comply with risk management, transparency, and monitoring requirements.

Ecosystem platforms will need compliance frameworks for apps/partners building AI solutions on top of their systems.

Expect new certifications for “AI-safe partners.”

7. Data Sovereignty & Residency

AI ecosystems will need to respect where data is stored and processed (especially sensitive sectors like finance and healthcare).

New legal requirements may emerge for MCP-style connectors to ensure jurisdictional compliance.

8. Content & IP Liability in AI

If a partner app uses your ecosystem’s AI integration to generate infringing or harmful content, who is liable?

Expect new indemnification clauses between ecosystem owners and partners around AI outputs.

9. Partnerships in AI Ecosystems

New legal structures are emerging:

MCP Integration Agreements: Standard contracts that govern AI connectors, defining data use, security, and attribution.

AI Partnership Programs: Legal frameworks for startups to build responsibly on larger AI platforms.

AI Agent Liability Frameworks: Clarifying who is accountable when autonomous AI agents take action across connected services.

10. Competition Law and Monopoly Relate to Business Ecosystems

1. Ecosystems as Moats vs. Monopolies

Moat: Ecosystems are defensible because they create network effects, switching costs, and interdependence.

Monopoly Risk: When one company controls too much of an ecosystem (e.g., distribution channel + platform + payments), regulators may view it as abuse of market dominance.

Example:

Apple’s App Store — ecosystem success (millions of apps, strong developer community).

But regulators in the US, EU, and UK scrutinize Apple’s 30% commission, app review policies, and tying of Apple Pay, arguing these restrict competition.

2. Multi-Sided Markets & Competition Law

Ecosystems are multi-sided platforms (serving end-users, developers, and advertisers simultaneously).

Competition law evaluates if the platform treats sides fairly.

Issues arise when the platform self-preferences (favoring its own apps/services over third-party ones).

Examples:

Amazon Marketplace accused of using seller data to launch competing products.

Google fined by the EU for self-preferencing Google Shopping in search results.

3. Network Effects and Barriers to Entry

Pro-competitive view: Network effects make ecosystems more valuable for all participants.

Anti-competitive risk: Once a platform reaches dominance, entry barriers rise for competitors because they cannot replicate the entire network (apps, partners, users).

Regulators often ask: Is the ecosystem creating unfair lock-in or allowing contestable competition?

4. Ecosystem Governance and Fair Access

Competition law intersects with ecosystem rules around:

Interoperability: Do ecosystems allow third parties to plug in, or block them? (EU Digital Markets Act requires “gatekeepers” like Apple/Google to allow interoperability).

Data Access: Who owns and controls data flows in the ecosystem? Refusal to share may be seen as abuse of dominance.

Exclusivity: Forcing partners or developers to work only with one ecosystem can be anti-competitive.

5. Regulatory Trends in Ecosystems

EU Digital Markets Act (DMA): Targets “gatekeepers” (Apple, Google, Amazon, Meta, Microsoft) to ensure openness, fair access, and prevent self-preferencing.

US Antitrust Reform: FTC and DOJ are challenging Big Tech ecosystems under abuse-of-dominance theories.

China: Tightened control over Alibaba, Tencent, and others to prevent closed ecosystems from restricting competition.

6. The AI Age: New Competition Law Challenges

AI Assistant Gatekeepers: If a few AI platforms (ChatGPT, Claude, Gemini) become the default interfaces for information, they may control visibility for businesses — similar to Google Search dominance.

MCP & Open Standards: Protocols like MCP could reduce monopoly risks by creating interoperability — but platforms that control MCP adoption could themselves become gatekeepers.

Data Monopolies: Ecosystem leaders with proprietary datasets (health, finance, commerce) may face scrutiny if they refuse AI platforms fair access.

Key Tensions

Value Creation vs. Market Power: Ecosystems create real value (jobs, innovation, third-party revenue), but regulators worry when one firm captures disproportionate control.

Innovation vs. Control: Too much control stifles partner innovation; too little governance creates instability and risk.

Open vs. Closed: Open ecosystems (APIs, MCP) invite competition; closed ones (walled gardens) risk regulatory intervention.

Financial Plan

1. Investment in Infrastructure

Before revenue flows, an ecosystem requires upfront financial commitments:

API & MCP Development: Building secure, scalable interfaces and developer tools.

Marketplace Platform: Infrastructure for app listings, partner onboarding, ratings, payments.

Developer Enablement: Documentation, SDKs, sandbox environments, hackathons.

Compliance & Governance: Auditing, certification, and risk management systems.

Community Building: Events, forums, and grants to grow developer and partner engagement.

Budgeting rule of thumb: The first 12–24 months are cost centers; monetization accelerates once adoption reaches critical mass.

2. Revenue & Monetization Models

Ecosystems need mechanisms to generate shared value. Common models:

Revenue Share (Marketplace Model):

Apple App Store: 30% cut (15% for smaller devs).

Shopify: % of app/partner revenue.

Microsoft AppSource: revenue split with ISVs.

Requirement: Payment rails that handle global currencies, compliance, tax withholding.

API Monetization (Usage-Based):

Charge per API/MCP call, tiered by volume.

Example: AWS API Gateway, Twilio, Stripe.

Requirement: Metering and billing systems with granular usage tracking.

Subscription / SaaS Add-Ons:

Monthly fees for ecosystem services, premium integrations, or marketplace listing tiers.

Transaction Fees:

Taking a cut of commerce processed via the platform (Amazon Marketplace).

Certification Fees:

Charging partners for training, verification, or listing in the marketplace.

Affiliate / Referral Incentives:

Revenue kickbacks for partners driving customers.

3. Payments Mechanisms

Building an ecosystem requires multi-party financial plumbing. Key mechanisms include:

A. Payment Collection & Distribution

Merchant of Record (MoR): The platform (e.g. Apple, Amazon) collects payments from end users, then distributes revenue to developers/partners.

Direct Payments: Partners handle their own transactions, and the platform takes a reporting-based commission.

B. Settlement Systems

Need automated systems for splitting payments between multiple parties.

Stripe Connect, PayPal Adaptive Payments, and Adyen MarketPay are common solutions.

C. Global Tax & Compliance

VAT/GST collection across jurisdictions.

Withholding tax management for international partners.

Regulatory compliance (PSD2 in Europe, PCI DSS for card security).

D. Escrow & Dispute Mechanisms

Holding funds in escrow for marketplaces until services are delivered.

Dispute resolution systems for chargebacks or fraud.

E. Incentive Flows

Grants & Credits: Funding for early developers to seed the ecosystem (AWS Credits, Shopify App Dev Fund).

Revenue Bonuses: Higher revenue share for strategic partners.

Co-Marketing Budgets: Joint go-to-market funding with partners.

4. Financial Metrics to Track Ecosystem Health

Gross Merchandise Value (GMV): Total sales transacted via the ecosystem (Amazon Marketplace, Apple App Store).

Take Rate: Percentage captured by the platform (e.g., 10–30%).

Partner Revenue: Income generated by third parties — a proxy for ecosystem strength.

Ecosystem GDP: Combined value created by apps, partners, and services.

Partner Retention Rate: Financial stickiness of ecosystem participants.

AI Agent & MCP Financial Models

Ecosystem financial models will extend further:

MCP Call Fees: Companies may charge per request when AI assistants (ChatGPT, Claude, Gemini) query their data via MCP.

AI Agent Commissions: If autonomous agents transact on behalf of users, ecosystems will need rules for micro-payments and commissions.

Data Licensing Models: Ecosystems may monetize real-time data feeds by licensing access to AI platforms.

Revenue Sharing with AI Platforms: Expect new financial agreements where companies share fees with OpenAI, Anthropic, or Google for privileged integrations.

Tech Plan

APIs & SDKs

Foundation for opening up the platform to developers.

SDKs (software development kits) make integration easier.

REST, GraphQL, and now MCP (Model Context Protocol) are standards.

App Marketplaces / Distribution Platforms

Central place where partners can publish, monetize, and distribute extensions.

Includes review, ratings, governance, and discovery mechanisms.

Identity & Authentication Systems

Single sign-on (SSO), OAuth, and secure credentials for partners and users.

Critical for multi-tenant ecosystems where trust is shared.

Developer Tools & Sandboxes

Documentation, testing environments, and simulators.

Developer portals with analytics on usage, revenue, and performance.

Payments & Billing Infrastructure

Revenue sharing models (commissions, API usage metering).

Global payments, tax handling, and fraud prevention.

Community Infrastructure

Forums, events, hackathons, training resources.

Technical evangelism and DevRel (developer relations) teams.

Governance & Security Controls

App review processes, certification programs, compliance enforcement.

Data protection (GDPR, HIPAA, financial regulations).

AI & Data Interoperability (emerging)

Protocols like MCP to make data/tools accessible to AI assistants.

Standardized schemas for interoperability.

Across all of these, the technical pattern is the same:

APIs + SDKs (open the door)

Marketplaces (organize and monetize contributions)

Identity + Payments (trust + financial plumbing)

Community + Governance (scale sustainably)

This stack is what makes a company shift from a product provider to a platform orchestrator.

APIs: The Backbone of Platform Ecosystems

How did Apple, Shopify, Amazon and others actually enable these ecosystems? At the technical core of every successful platform ecosystem is a set of APIs (Application Programming Interfaces) and developer tools that open up the platform to outside innovation. APIs are what turned products into platforms – they allow third parties to safely hook into a company’s data or services and build new capabilities on top. Apple’s iOS APIs let developers create apps that could run seamlessly on the iPhone. Shopify’s APIs let app makers interface with store data (orders, inventory, checkout) to extend merchant capabilities. Amazon exposed APIs to sellers for listing products and to developers for cloud services. In each case, APIs acted as the connective tissue of an ecosystem, enabling external innovators to integrate with the platform’s core.

This API-centric openness is what unlocked network effects at scale. By lowering integration barriers, APIs invited a flood of creativity from outside the company’s walls – effectively outsourcing much of the innovation. As Salesforce’s success with its AppExchange marketplace shows, APIs are “strategic assets” as much as technical ones, enabling new revenue streams and expanding a platform’s value proposition by catalyzing a whole marketplace of extensions. In the enterprise world, an “API economy” has taken shape, where companies publish APIs not just for partners but sometimes even for competitors, knowing that the platform that aggregates the most third-party value wins. For executives, the lesson is clear: investing in APIs and developer ecosystems is not a side project – it’s become central to competitive strategy in the digital era. The companies that mastered this in the last decade built robust platforms that weathered disruption. Now, as we enter the next wave of technology with AI, the same pattern is emerging in a new form.

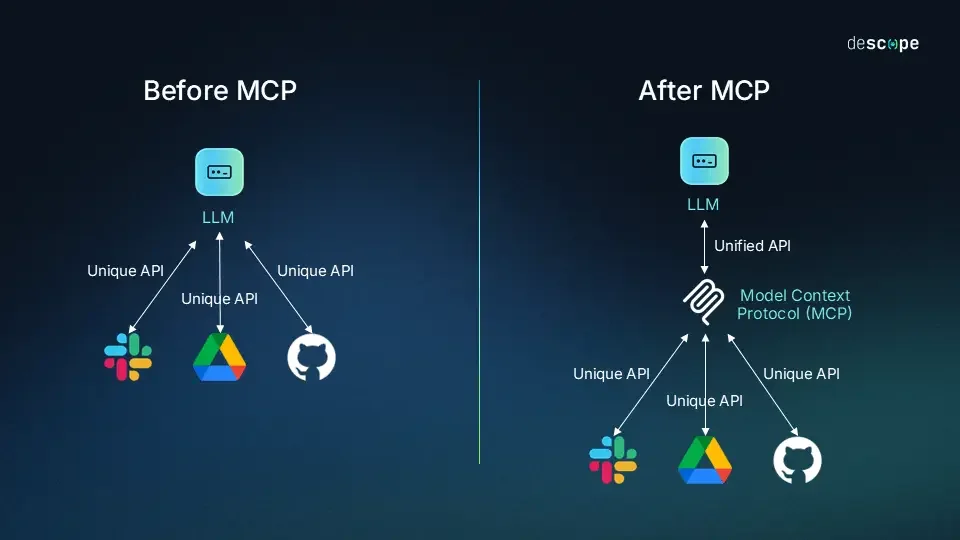

From APIs to AI: Enter the Model Context Protocol (MCP)

If APIs were the foundation of ecosystems in the web and mobile era, the AI-native era demands its own connective standard. Model Context Protocol (MCP) is quickly gaining prominence as that next-generation bridge – a kind of “universal adapter” for plugging AI systems into your business. In late 2024, AI pioneer Anthropic (maker of the Claude AI assistant) introduced MCP as an open standard to connect AI assistants to the systems where your data and tools live. Think of how USB-C ports standardized how we connect devices: MCP similarly provides a standardized interface for AI models to access different data sources, software, and services. Instead of bespoke one-off integrations or proprietary plugins for each AI or each application, MCP offers a common protocol. Major AI providers swiftly embraced this approach – Anthropic open-sourced MCP and saw adoption from OpenAI and Google DeepMind (among others) in short order. In practical terms, this means a company can expose its databases, software tools, or SaaS apps via MCP once, and multiple AI platforms (from OpenAI’s ChatGPT to Anthropic’s Claude to emerging systems like Google’s Gemini) could all access those resources in a consistent, secure manner.

For enterprise leaders, MCP represents critical infrastructure for the AI age – essentially the evolution of the API for a world where AI agents handle more and more queries and tasks. Just as an API offers a documented, standard way for one software system to leverage another’s services, MCP offers a documented, standard way for AI programs to integrate external services and data. This protocol enables AI agents to go beyond their trained knowledge and safely interact with real-time information and enterprise systems. Imagine ChatGPT autonomously pulling inventory data from your database or triggering actions in your CRM on behalf of a user query – MCP is designed to make such scenarios plug-and-play across platforms. It breaks down the “information silos” that currently limit AI utility, by replacing fragmented, custom integrations with one universal language. Early adopters are already seeing the benefits. Companies like Block (Square) and Shopify’s partner Replit have begun integrating MCP to let AI agents tap into internal tools, improving everything from coding assistants to customer support bots. Cloud software firms like Sourcegraph and Codeium are using MCP to give AI deeper context (e.g. retrieving knowledge from private codebases) – a competitive advantage made possible by embracing a standard connector.

In short, MCP is the next frontier in ecosystem-building. It extends the platform mindset into the AI realm: your company’s data, products, and services can become part of the AI-native internet, accessible wherever intelligent agents operate. As MCP rapidly becomes an industry standard, being part of its ecosystem ensures that your business’s capabilities are “on the grid” of AI services. The AI platforms of today and tomorrow – be it ChatGPT, Claude, Bing or Perplexity search agents, or Google’s forthcoming Gemini – are poised to interface with external systems through protocols like MCP. Forward-looking enterprises are now asking: Is our organization’s value accessible to these AI agents, or are we sealed off? Those that plug in via MCP could see their reach and relevance greatly amplified by AI; those that don’t risk being invisible in the new paradigm where AI intermediaries drive usage.

Technologies Provided by Leading Ecosystem Builders

Apple

SDKs & APIs: iOS SDK, Swift, ARKit, HealthKit, CoreML.

Marketplace: App Store.

Identity: Apple ID, Sign in with Apple.

Payments: Apple Pay, in-app purchases.

Community: WWDC (Worldwide Developers Conference), developer portal.

Defensibility: Tight integration of hardware + OS + apps, supported by proprietary developer tooling.

Microsoft

SDKs & APIs: .NET framework, Azure APIs, Office APIs.

Marketplaces: Azure Marketplace, Microsoft AppSource.

Developer Tools: Visual Studio, GitHub.

Identity: Microsoft Entra (Azure Active Directory).

Community: GitHub community, Microsoft Learn, Build conference.

Defensibility: Embedded into enterprise workflows and developer pipelines.

Amazon

SDKs & APIs: AWS APIs, Alexa Skills Kit.

Marketplace: Amazon Marketplace (retail), AWS Marketplace (cloud).

Payments: Amazon Pay, third-party seller settlements.

Developer Tools: Lambda (serverless), CloudFormation templates.

Community: AWS re:Invent conference, developer user groups.

Defensibility: Network of sellers + cloud ecosystem built on AWS APIs.

SDKs & APIs: Android SDK, Google Cloud APIs, Maps API, YouTube Data API.

Marketplace: Google Play Store, Google Cloud Marketplace.

Identity: Google Accounts, OAuth 2.0.

Payments: Google Pay, in-app billing.

Community: Google I/O, TensorFlow open source community.

Defensibility: Global scale of Android + distribution channels (Ads, YouTube).

Meta (Facebook)

APIs: Graph API, Instagram Basic Display API, WhatsApp Business API.

Developer Tools: Facebook SDKs, analytics tools.

Marketplace: Ad ecosystem as distribution engine.

Community: F8 developer conference, Meta for Developers portal.

Defensibility: Scale of social graph and ad infrastructure.

Shopify

APIs: Storefront API, Admin API, GraphQL APIs.

Marketplace: Shopify App Store, Theme Store.

Identity: Shopify Plus partner certification.

Payments: Shopify Payments, revenue share with developers.

Community: Shopify Unite conference, Partner Academy.

Defensibility: Partners and apps generate more revenue than Shopify itself.

Salesforce

APIs: REST and SOAP APIs for CRM data.

Marketplace: AppExchange.

Developer Tools: Salesforce Lightning, Heroku.

Community: Trailhead (training), Trailblazer Community.

Defensibility: Deep embedding into enterprise workflows.

Nvidia

SDKs & APIs: CUDA, cuDNN, TensorRT, Omniverse APIs.

Marketplace: NGC (Nvidia GPU Cloud) for AI models.

Developer Tools: Nsight developer suite, CUDA toolkit.

Community: Nvidia Developer Program, GPU Technology Conference (GTC).

Defensibility: CUDA lock-in; massive developer adoption.

n8n (open source)

Core Tech: Node-based workflow automation.

APIs: Connectors to 1,000+ third-party services.

Marketplace: Community-driven node library.

Community: Open-source contributors, GitHub repos, Slack groups.

Defensibility: Global participation; innovation speed from open-source.

Product Roadmap

Without MCP, companies risk building fragile ecosystems that are slow, fragmented, and easily bypassed. With MCP, they build resilient ecosystems that thrive on interoperability, network effects, and AI visibility. MCP is Critical to Ecosystem Maturity:-

Stage 1. Isolated Product (0–12 months)

What it looks like:

Focused on selling a standalone product/service.

Limited integrations, minimal developer or partner engagement.

Growth driven by direct sales & marketing.

Risks:

Vulnerable to copycats (no-code, clones, competitors).

Limited resilience → customer churn if a better product appears.

Role of MCP:

At this stage, MCP = future readiness.

Audit shows them what visibility gaps exist.

Early MCP experiments (single connector) start opening their data.

Stage 2. Connected Product (12–24 months)

What it looks like:

Product gains traction, adds integrations & APIs.

Starts forming partner relationships.

Developer documentation exists, but community is small.

Ecosystem Levers:

Launch integrations marketplace.

Run first hackathons or innovation challenges.

Encourage early partners to build on top of the platform.

Role of MCP:

MCP accelerates integrations: instead of building custom APIs for each partner, one protocol makes their data usable across all major AI assistants.

Visibility grows → they start appearing in AI-generated answers.

Stage 3. Platform Emergence (24–36 months)

What it looks like:

Multiple integrations + a community of developers.

App marketplace/plugins gaining traction.

Recognized industry partnerships.

Ecosystem Levers:

Incentivize devs (revenue sharing, app store).

Formalize partner programs (training, co-marketing).

Expand hackathons & conferences.

Role of MCP:

MCP becomes their ecosystem glue.

Partners and devs plug into their MCP-enabled data instead of building integrations from scratch.

Their brand becomes the trusted data source for AI agents and assistants.

Stage 4. Ecosystem Hub (36–60 months)

What it looks like:

Strong network effects: customers, developers, partners all interdependent.

Marketplace revenue rivals or surpasses core product revenue.

Company becomes a default node in its vertical (like Shopify in commerce).

Ecosystem Levers:

Scale developer ecosystem globally.

Formal accelerator/incubator programs for startups building on the platform.

M&A to absorb promising ecosystem players.

Role of MCP:

MCP powers resilience: their ecosystem is deeply wired into AI platforms, partners, and apps.

Even if competitors copy features, they can’t replicate the mesh of dependencies.

Stage 5. Orchestrator (60+ months)

What it looks like:

Ecosystem is the moat.

They set industry standards (protocols, schemas).

They don’t just participate in the ecosystem → they run it.

Ecosystem Levers:

Expand into adjacent industries.

Influence standards bodies and policy.

Position as the backbone of AI integration in their vertical.

Role of MCP:

MCP is central to orchestrating not just their ecosystem, but the wider AI economy.

They become the authority layer AI models rely on for accurate, real-time data.

This is “Apple App Store” or “Shopify ecosystem” level resilience.

Investor Guidance

Investment Thesis: Ecosystems as the Moat in the Age of AI

Core Belief

In an era where products can be copied in days (via no-code tools, open-source repos, or commoditized AI models), the companies that will dominate are not those with the best standalone products, but those that own ecosystems.

Ecosystem strength — measured by integrations, partnerships, developer participation, and interoperability — is the true moat of the AI age. The glue that binds these ecosystems will be MCP (Model Context Protocol) and related interoperability standards.

Why Ecosystems Matter Now

Product Commoditization: Generative AI accelerates feature copying. What was once a 12-month technical advantage is now 12 days.

Distribution Shifts: AI assistants (ChatGPT, Claude, Perplexity, Gemini) are becoming the new “search engines” — companies must ensure their data flows into these channels or risk invisibility.

Network Effects as Resilience: Ecosystems compound value. The more integrations, apps, and partners built around a company, the harder it is to disrupt.

History Repeats: The winners of previous tech waves (Apple, Shopify, Salesforce, AWS, n8n) became hubs, not point solutions.

The MCP Opportunity

MCP is the next API revolution.

Just as REST APIs and app stores unlocked SaaS ecosystems, MCP will unlock AI-native ecosystems.

MCP makes companies “AI-visible” and connects their data/tools to the growing universe of AI agents, copilots, and assistants.

Companies that MCP-enable early can entrench themselves as default sources of truth in their industries.

Investment Pillars

Ecosystem Readiness

Companies with APIs, SDKs, developer programs, or marketplaces.

MCP integration planned or in progress.

Evidence of external adoption (partners, apps, integrations).

Ecosystem Flywheel Potential

Multi-sided network effects: users + developers + partners.

Ability to monetize beyond product (API calls, app store, revenue share).

Expanding into adjacent verticals.

Community & Participation

Active developer/user community.

Hackathons, accelerators, or open-source contributions.

Low friction for outsiders to innovate on top of the platform.

Resilience & Defensibility

Switching costs: integrations, workflows, dependencies.

Brand visibility in AI assistants.

Ecosystem participants deriving direct revenue from the platform.

Vision & Standards Leadership

Founders who talk about platforms, not products.

Involvement in setting interoperability standards (MCP, schemas).

Potential to become the orchestrator of their vertical.

Sectors with Ecosystem-As-A-Moat Opportunities

AI Data & Knowledge Platforms → Vertical sources of truth (finance, health, supply chain).

AI-Enabled SaaS → Companies that extend into marketplaces & APIs.

Infrastructure & Dev Tools → Low-code/no-code, automation, orchestration (like n8n).

Commerce & Marketplaces → Next-gen Shopify for AI-first commerce flows.

Community Platforms → Ecosystems anchored in creators, educators, and open source.

Exit Scenarios

Strategic Acquisition: Larger players (cloud providers, hyperscalers, SaaS giants) acquire ecosystem hubs for their network effects.

Platform IPO: Ecosystem companies can IPO not just on ARR, but on their ecosystem GDP (the revenue they enable across partners).

Ecosystem Consolidation: Orchestrators roll up smaller ecosystem players to strengthen their hub position.

Thesis Summary

In the AI era, products will not be defensible. Ecosystems will. The next generation of category leaders will be those that use MCP to unlock integrations, build communities, and orchestrate ecosystems that others depend on.

Our investment focus is on founders with an ecosystem mindset, measurable ecosystem strength, and a roadmap to become the default hub in their vertical.

Top Startups Embracing Ecosystem-as-a-Moat in the AI Era

In line with the investment thesis that ecosystem strength is the true moat of the AI age, the following startups exemplify platforms with robust integrations, developer communities, and interoperability (often via emerging standards like MCP). These companies have moved beyond standalone products to become hubs that others build upon, making them resilient to copycats and pivotal in their domains:

Hugging Face – Open AI Model Repository & Community Platform. Hugging Face has become the de facto hub for machine learning models, datasets, and AI applications, with an open community contributing over 1.7 million models and 400k datasets. This “GitHub of AI” integrates with all major ML frameworks and cloud providers, encouraging interoperability and standardization. Hugging Face’s ecosystem (including Spaces apps and an Agents API) allows developers and partners to build on its platform and plug models into various AI systems. By setting open standards for model sharing and hosting an unparalleled community, Hugging Face positions itself as a trusted source of truth for AI models and data – a critical role as AI assistants (from ChatGPT to Claude) pull from external knowledge bases. Its community-centric approach (with features like Spaces as MCP servers and integrations for real-time model inference) ensures that no single player can easily displace its ecosystem moat.

Zapier – No-Code Integration Platform Connecting Thousands of Apps. Zapier boasts the largest integration ecosystem in automation, connecting over 5,000 apps (now 7,000+ as of 2023) via its no-code workflow engine. Over the past decade, Zapier cultivated a massive network of partners and third-party developers who continually add new “Zaps” and connectors – network effects competitors struggle to replicate. Crucially, Zapier is making itself indispensable in the AI era by enabling AI agents to leverage this app network: it introduced a ChatGPT plugin and announced Zapier MCP support to let any AI assistant perform actions across those thousands of integrated apps. In short, Zapier has evolved from a simple automation tool into an integration backbone for both humans and AI, with multi-sided network effects (users, app partners, now AI agents). Its ecosystem-driven resilience is evident in that even if new automation tools emerge, they cannot easily replace Zapier’s breadth of connectors and partner buy-in.

n8n – Open-Source Workflow Automation with Community Integrations. n8n is an emerging Zapier alternative that leverages open source to build an ecosystem moat. It provides a plug-in framework for “nodes” (integrations) and has fostered a community that created nearly 2,000 custom nodes published on npm. This year, n8n launched a built-in community nodes marketplace, allowing users (including non self-hosted cloud users) to discover and install community-built integrations with one click. By embracing community contributions and partner-built extensions, n8n rapidly expanded its long-tail integrations (8+ million community node downloads) and lowered integration friction. The result is a thriving ecosystem where developers and even SaaS vendors build on n8n to reach users. As AI assistants gain the ability to execute workflows, n8n’s MCP compatibility and rich integration library make it a default automation mesh that’s hard for any single competitor to clone. Its network effects (user automations, contributor nodes, vendor partnerships) give it resilience despite being a younger company, following the playbook of open-source hubs like Node-RED and Kubernetes.

Coda – All-in-One Doc Platform Turning into a Developer Ecosystem. Coda started as a next-gen document/spreadsheet tool, but it deliberately transformed into a platform with a thriving third-party Pack ecosystem. “Packs” are Coda’s version of integrations or mini-apps: Coda opened a Packs SDK and API so developers could extend Coda docs with custom functionality (connecting to external services, adding UI widgets, etc.). In 2022, Coda launched a Pack Marketplace that allows makers to publish and even sell their Packs to Coda’s user base. This shift handed over the keys to the community – enabling developers to build businesses on Coda and greatly expanding Coda’s capabilities via community-built add-ons. As one Coda team member noted, the incentives for third parties to build connectors make Coda a “centerpiece” where people orchestrate all their work in one place. Coda also uses interoperability standards (it has an API, and integrates with Zapier, etc.) to ensure it fits into broader workflows. By moving from isolated product to platform+marketplace, Coda has developed a moat where each new Pack or integration increases Coda’s stickiness and value. The ecosystem creates switching costs and network effects (for example, teams adopt Coda not just for the doc tool itself, but for the library of Packs and integrations available).

LangChain – Developer Framework & “App Store” for LLM-Powered Apps. LangChain is an open-source framework that has quickly become foundational for building generative AI applications, precisely because of its ecosystem-centric design. It provides standard modules to chain LLMs with data sources, tools, and APIs – and has attracted a huge community (over a million developers and tens of thousands of companies) who contribute integrations and use its components. LangChain’s strength lies in its composability: it integrates dozens of vector databases, knowledge sources, and model providers, allowing developers to swap in tools and models as needed. There’s even a LangChain Hub for sharing prompts and chains, and adapters for MCP that let LangChain agents tap into any MCP-compatible tool (from Google Calendar to Slack) via one protocol. In effect, LangChain is evolving into the “app store” for AI agent capabilities, where an extensive partner ecosystem (data connectors, model plugins, evaluation modules, etc.) grows around the core framework. This gives LangChain a defensible position – its value isn’t just the code itself (which others could fork), but the critical mass of integrations and community knowledge built around it. As the AI stack standardizes, LangChain is poised to be the glue layer developers default to, benefitting from network effects (more users -> more community-contributed integrations -> even more users) and making it tough to displace.

OpenBB – Open-Source Finance Terminal Becoming a Data & Tools Hub. OpenBB (formerly Open Bloomberg Terminal) is a startup turning financial data software into an ecosystem play. The OpenBB Platform is an open-source, modular investment research platform that aggregates 100+ data sources across stocks, crypto, macro data, etc., under one roof. Importantly, OpenBB is extensible: it offers an extensions framework and encourages the community to build custom data connectors and analytics “toolkits” on top of the platform. By standardizing APIs and schemas for financial data, OpenBB makes itself the integration hub for finance apps and even AI agents (the company touts its platform for use by AI assistants to fetch financial info). Its growing community contributes new data providers and analysis modules, gradually compounding OpenBB’s value as the open financial data source. This ecosystem approach (similar to how Bloomberg became indispensable via its API and third-party plugin support) means OpenBB’s moat deepens with each new integration. Developers and quants can avoid reinventing the wheel by building on OpenBB, and partner companies can plug their datasets into a ready user base. In an industry where proprietary terminals lock in customers, OpenBB’s interoperability and network of contributors give it a shot at becoming the default platform in fintech/analytics – one that thrives on ecosystem effects rather than just proprietary features.

Replit – Cloud Development Platform & AI-Enabled Coding Hub. Replit has built a holistic developer ecosystem with over 20 million users sharing and collaborating on code in the cloud. It offers an extensions marketplace and APIs, allowing third-party tools to integrate into its online IDE. Notably, Replit is an early adopter of the Model Context Protocol (MCP), enabling AI agents to interface with Replit-hosted code and data seamlessly. By combining a passionate community with interoperability (e.g. Replit’s AI coding assistant and MCP support), Replit is entrenching itself as the go-to platform for coding, learning, and building software collaboratively.

Replit vs. Lovable

Revenue Velocity:

Combined Lovable + Replit ARR growth: $210M in 8 months

Loveable’s growth rate: 1,250% month-over-month in early months

Replit’s acceleration: 45% monthly subscriber growth post-Agent launch

User Economics:

Loveable: $2.2M ARR per employee (45 FTEs)

Replit: $1.5M ARR per employee (~65 FTEs)

Industry context: Typical SaaS companies achieve $200-400K ARR per employee

Adoption Patterns:

Loveable: 2.3M users, 180K paying subscribers

User-to-paid conversion: ~8% (industry benchmark: 2-5% for freemium)

Daily project creation: 100K+ across platforms

Organic growth: >80% of new users from word-of-mouth/viral sharing

Capital Efficiency:

Loveable: $100M ARR achieved with <$20M in total funding

Capital efficiency ratio: 5:1 (ARR:funding)

Compare to: Typical SaaS companies require $30-50M to reach $100M ARR

Each of these startups aligns with the core belief that owning an ecosystem is far more defensible than any standalone product feature. They have fostered integrations, marketplaces, and standards adoption (e.g. MCP) that lock in network effects and visibility in the AI-driven landscape. Investors looking for durable advantages in the AI era should watch for such companies that don’t just build products, but build platforms others depend on – creating a self-reinforcing moat of interoperability, community and data that is hard to disrupt.

The Index

Measuring AI-Era Ecosystem Resilience and Power

Introduction: In the AI era, a company's ecosystem – the breadth of its products, integrations, community, and partnerships – has become a critical source of competitive advantage. Industry leaders emphasize that “the future won’t be built in isolation” and that transformative innovation will come from collaboration across communities, partners, and enterprises. A robust ecosystem can even form a defensive “moat” that competitors struggle to replicate. To quantify this, we propose an Ecosystem Strength Index (ESI) that scores how resilient and powerful a company’s ecosystem is across several dimensions. Each dimension (detailed below) is scored, and the sum (0–60) indicates the company’s overall ecosystem strength.

ESI Dimensions and Criteria

Each dimension captures a key aspect of ecosystem strength, with specific indicators and point values. A higher score means a stronger, more resilient ecosystem in that category.

1. Product & Offering Breadth (0–10 points)

This dimension assesses how diverse and ecosystem-ready the company’s core product stack is. Companies with broad, modular AI offerings across multiple use cases tend to build stronger ecosystems. For example, many top SaaS platforms (e.g. Zapier, HubSpot, Miro, Notion, Canva) succeed by serving more than one industry or use-case, which expands their reach. Key indicators include:

✅ Proprietary AI Models, APIs, SDKs (3 pts): The company develops its own AI models or tools (e.g. ML models, NLP engines, APIs) that others can build upon. Only a handful of firms (Google, Meta, Microsoft, etc.) have the resources to train such models at scale, so having proprietary AI tech signals a strong foundation.

✅ Multiple AI-Powered Products Across Use Cases (2 pts): They offer a suite of AI-driven products spanning different functions or sectors (horizontal platform). Serving multiple needs or industries provides “endless opportunities” for expansion and cross-product network effects.

✅ Modular Design (APIs, Headless Services, Plug-ins) (2 pts): Their products are built to be extensible – offering open APIs, plug-in frameworks, or headless services that allow easy integration and customization. A modular, API-first design lets external developers extend the product. For instance, offering plug-in support gives “endless opportunities to customize SaaS applications to specific user segments”.

✅ Industry-Specific Offerings (Verticalization) (1 pt): They provide specialized AI solutions tailored for certain industries or verticals. This indicates depth in addressing niche user needs and shows the ecosystem can cater to vertical markets. (For example, some AI firms offer finance-specific or healthcare-specific toolkits.)

✅ Evidence of Product Adoption (Usage & Growth) (2 pts): Strong adoption metrics (e.g. millions of active users, high usage growth, GMV processed) demonstrate ecosystem traction. Broad usage suggests the products deliver value at scale, attracting more partners and developers. High MAUs or usage stats validate the ecosystem’s vitality.

2. Integrations & Interoperability (0–10 points)

This dimension measures how well the company’s offerings connect with the outside world. In the AI ecosystem, openness and connectivity are essential – no one innovates alone. A truly interoperable platform invites many integrations, making it more useful and sticky. Key indicators:

✅ Number of Official Integrations/APIs (3 pts): The count and breadth of integrations available (APIs, connectors, plug-ins to other services). A high number signals an open platform. For example, Slack’s platform supports over 6,400 third-party apps (with ~2,600 directly on its app directory), illustrating how extensive integrations make a product more versatile and widely adopted.

✅ MCP Readiness / Connectors to AI Platforms (2 pts): Support for emerging standards or protocols (like the Model Context Protocol, MCP) and connectors to popular AI/ML platforms. Being “MCP-compatible” means AI agents can plug into the product easily. MCP provides a simple, standardized way for AI agents to connect to tools and data – effectively plug-and-play. A company ready for such standards can integrate into AI-driven workflows with minimal friction.

✅ Partnerships for Data & Cloud Integration (2 pts): The product natively integrates with major cloud providers, SaaS apps, data sources or has partnership-based connectors. Examples include being listed on cloud marketplaces or having official add-ons for Salesforce, AWS, etc. Such partnerships expand the ecosystem’s reach into established platforms.

✅ Standardization & Open Protocols (1 pt): Adherence to open standards and protocols (e.g. open APIs, data formats, interoperability standards) which makes integration easier. An open-source or open-standards approach yields flexibility and interoperability, fostering a global innovation community rather than vendor lock-in. Compliance with standards (OAuth, ONNX, etc.) signals ecosystem-friendliness.

✅ Developer “Plug-and-Play” Ease (2 pts): The ease with which developers can connect and build on the platform (minimal custom code needed). This could include well-documented SDKs, sandbox environments, quick-start templates, and low-friction authentication. When integration is as simple as “plug in and go,” more third parties will incorporate the product into their solutions, multiplying the ecosystem’s presence.

3. Community & Developer Engagement (0–10 points)

A vibrant developer and user community greatly amplifies an ecosystem’s strength. This dimension evaluates how alive and active the ecosystem’s community is, and how much external contribution it attracts. A strong community accelerates innovation and adoption through network effects. Key indicators:

✅ Active Community Channels (GitHub, Discord, Forums) (2 pts): The presence of active developer forums, Discord/Slack groups, open-source repos, etc., and frequent discussions or Q&A. For open-source AI projects especially, community engagement is a key value indicator. For instance, a high number of GitHub stars or forum members suggests many developers are interested and involved.

✅ Contributions from Outside Developers (2 pts): Evidence that external developers contribute to the ecosystem – such as open-source pull requests, third-party plugins/extensions, community translations, etc. When outsiders build on or improve the product, it indicates a healthy, participatory ecosystem. Organizations even develop custom KPIs to track community contribution quality and growth rates.

✅ Hackathons, Developer Challenges or Open Innovation Programs (2 pts): The company actively fosters innovation via hackathons, contests, or grants. Hackathons are known to accelerate innovation and turn participants into advocates, while rapidly expanding the developer community. Major tech firms (Google, IBM, Microsoft, etc.) host hackathons (e.g. Google’s AI Hackathons, IBM’s Call for Code) to engage developers and showcase new use-cases, which drives community growth and fresh integrations.

✅ Developer Resources & Evangelism (2 pts): High-quality documentation, SDKs, how-to guides, sample code, and dedicated developer relations teams. Clear docs and tutorials lower entry barriers for new developers. Active evangelism (blogs, webinars, dev conferences) helps keep the community educated and excited. For example, open-source projects often credit good documentation and onboarding materials as key to growing contributions.

✅ Community Events & Advocacy (2 pts): The company sponsors or hosts community-led events (meetups, user groups, an annual developer conference). A flagship developer conference (like Google I/O, AWS re:Invent) or community summit can galvanize thousands of participants, showcasing ecosystem updates and giving contributors a sense of belonging. Such events and ambassador programs turn users into evangelists, fueling organic growth.

4. Partnership & Platform Network (0–10 points)

Beyond product integrations, this dimension looks at the breadth and strength of the company’s partner network. Being well-connected with other industry players can turn a company into a central hub of an ecosystem. Key indicators:

✅ Strategic Partnerships (3 pts): Formal alliances with major tech companies or industry leaders. This could include co-development deals, technology-sharing partnerships (e.g. an AI model lab with another tech giant), or being a preferred provider for big enterprises. Such strategic ties extend the company’s influence. In the AI domain, no single organization can tackle everything alone – enterprise AI reaches its full potential through strong partner ecosystems uniting technology, expertise, and support.

✅ Industry Consortiums/Alliances (2 pts): Participation in industry-wide initiatives, standards bodies, or consortiums (for example, Partnership on AI, cloud native computing alliances, etc.). Being at the table to set standards or policies indicates leadership and gives early access to industry knowledge. Alliances also reinforce credibility and ensure the company’s technology integrates with broader industry efforts.

✅ Distribution & Channel Partnerships (2 pts): Having reseller networks, channel partners, or OEM agreements that distribute the company’s product. A wide partner channel means the product can reach more customers through others’ salesforces. For instance, a smaller AI SaaS might partner with a global consulting firm or a cloud marketplace for distribution – extending its ecosystem presence indirectly.

✅ Co-Marketing or Joint Launches (1 pt): The company frequently co-markets with partners or does joint product launches, signaling tight-knit relationships. Examples: a joint press release with a cloud provider for a new integration, or being featured in a partner’s conference keynote. This shows mutual investment in each other’s success.

✅ Depth and Diversity of Partner Ecosystem (2 pts): The overall number of partners and their diversity across industries and domains. A robust partner program might include system integrators, value-add resellers, tech partners, startups, universities, etc. Depth is measured by both quantity and the variety of sectors covered. For instance, Red Hat’s ecosystem brings together hardware vendors, cloud providers, and integrators to help deploy AI solutions – a broad coalition that makes the platform more ubiquitous while avoiding single-vendor lock-in.

5. M&A and Strategic Investments (0–5 points)

This dimension captures how active the company is in shaping the ecosystem via capital – through acquisitions, investments, or being acquired itself. In fast-moving fields like AI, mergers and acquisitions (M&A) can rapidly expand a company’s capabilities and ecosystem influence. Indicators:

✅ Acquisitions of AI Startups or Data Companies (2 pts): The company has acquired smaller AI firms, data providers, or tech startups to bolster its ecosystem. Over the last decade, AI-related acquisitions have surged – deals involving AI companies more than doubled from 225 in 2014 to 494 in 2023. Major players like Google, Amazon, Apple, and Microsoft have led the way in “absorbing nascent AI companies” to augment their platforms. An active acquisition strategy can fill product gaps and bring in new communities of users/developers.

✅ Strategic Investments / Corporate VC (1 pt): The company makes minority investments in relevant startups or has a corporate venture arm. This extends the ecosystem by nurturing innovative companies (for example, Salesforce Ventures investing in AI startups that later integrate with Salesforce). It signals commitment to the ecosystem’s future.

✅ Receiving Strategic Investment / Being Acquired (1 pt): Conversely, the company itself might receive large strategic investments or be acquired by a larger ecosystem player. This can inject resources and instantly broaden the company’s ecosystem reach (e.g., a small AI tool being acquired by a big cloud provider means integration into a much larger platform ecosystem).

✅ Post-Merger Integration Success (1 pt): Whether acquisitions or partnerships actually translate into integrated products and communities. It’s not just the deal count, but also how well the acquired technologies and teams are integrated. Successful integration (e.g., merging user bases, combining datasets, or seamlessly plugging a new tool into the platform) will strengthen the ecosystem, whereas failed integrations mean missed opportunities.

6. Innovation Velocity (0–5 points)

This dimension looks at the pace of innovation and openness in driving the ecosystem forward. In AI, the landscape changes rapidly – companies that experiment and iterate quickly can pull the ecosystem along with them. Indicators:

✅ Frequency of Feature Launches / Updates (1 pt): How fast the company rolls out new features, products, or improvements. A high cadence (weekly or monthly updates, frequent AI model upgrades) shows the ecosystem is on the cutting edge. Innovation velocity – the speed of bringing new capabilities to market – is now recognized as a competitive factor in AI. Fast movers can set de-facto standards before slower competitors react.

✅ Open-Sourcing Tools or Datasets (1 pt): The extent to which the company open-sources parts of its technology or contributes to open AI projects. Open-sourcing certain AI models, libraries, or datasets can accelerate adoption and become an industry standard (e.g. TensorFlow by Google, or Meta open-sourcing LLaMA). Strategic open-sourcing can foster ecosystem growth while maintaining the company’s leadership position – essentially seeding a wider community that still rallies around the company’s influence.

✅ Hackathon Sponsorships & Innovation Programs (1 pt): Sponsoring hackathons, research competitions, or internal hack weeks to drive experimentation. This overlaps with community engagement but specifically reflects a culture of innovation. Frequent hackathons (internal or external) signal that the company actively explores new ideas and encourages developers to build novel solutions (often leading to new integrations or spin-off features).