AI Adoption in Financial Advisory: Portfolio Explanations, Investment FAQs & Retirement Planning

Executive Summary

The financial-advisory sector is undergoing rapid transformation driven by large language models (LLMs) like ChatGPT. Consumers already use AI for investment questions, portfolio clarification, and retirement planning, while financial advisors themselves are adopting LLMs as co-pilots for planning, explanations, and client engagement.

This whitepaper compiles findings from eight authoritative articles across universities, industry giants, consulting firms, regulatory bodies, and financial publishers. The evidence shows:

AI is becoming a primary financial guidance tool for younger generations.

ChatGPT is now used for real financial decision-making, including product comparison and portfolio analysis.

Retirement planning is a high-value LLM application, with global institutions adopting AI for plan personalization and risk modeling.

Both benefits and risks exist: while AI improves clarity and access, poor prompt framing or blind trust can lead to financial loss.

Financial-advisory teams must design structured, compliant AI workflows to leverage its upside safely.

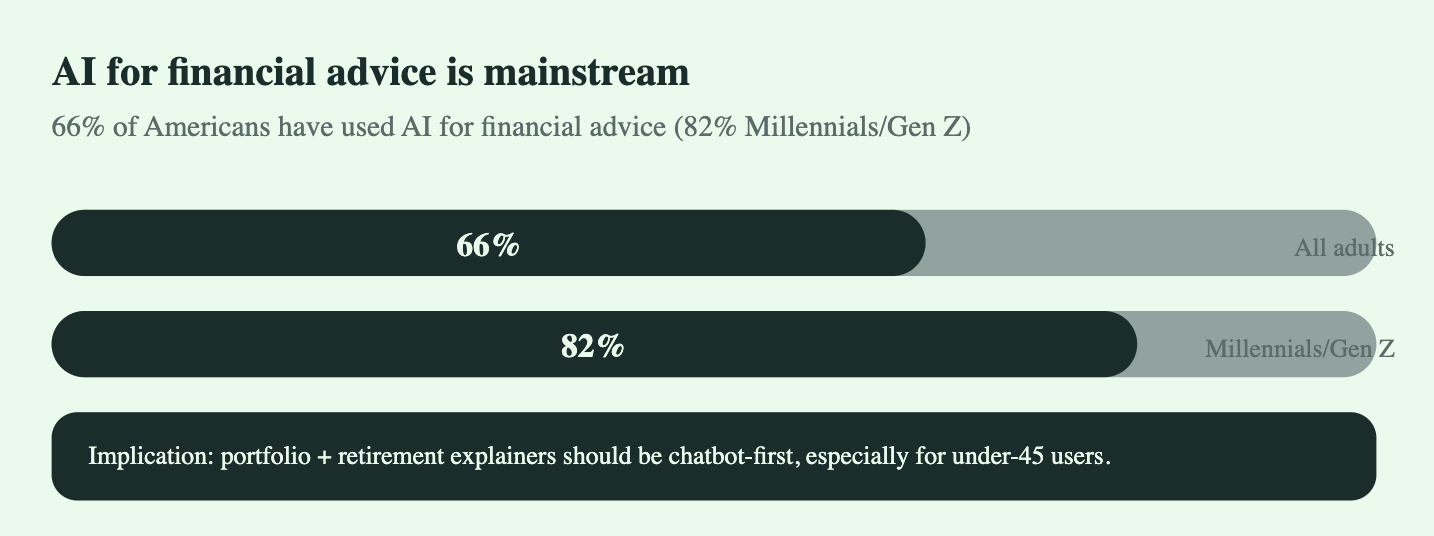

66% of Americans say they’ve used AI to seek financial advice (e.g., budgeting, investing, retirement), with 82% among Millennials/Gen Z.

54% of Americans have asked ChatGPT about financial products/services, and 47% have used it for investment advice.

Surveys cited in Reuters show 13% of investors already use AI tools for portfolio decisions; about 1 in 10 retail investors use chatbots for stock selection.

A SmartAsset survey reports 60% of financial advisors either use or are interested in using ChatGPT in client advisory workflows.

1. Market Context & User Behavior

1.1 Consumers Are Already Using AI for Financial Guidance

Across multiple surveys, AI has become a mainstream personal-finance tool:

Majority of adults have used AI for financial questions.

Millennials and Gen Z treat AI as their first stop for budgeting, investment rationale, ETF breakdowns, and retirement tasks.

ChatGPT is the most frequently used AI assistant for money-related queries.

The implication is clear:

Consumers expect on-demand, conversational, personalized explanations—not long PDFs, web articles, or dense prospectuses.

1.2 ChatGPT as a Financial Decision-Making Engine

Users engage ChatGPT to:

Explain investment products (ETFs, SIPs, mutual funds, REITs)

Compare options (index fund vs. active fund)

Break down portfolio allocations

Estimate retirement needs

Interpret risk, returns, fees, and diversification

Clarify jargon (expense ratio, beta, duration, etc.)

This is no longer a “toy use-case.”

People rely on LLMs for advice-adjacent decisions, often affecting real money.

1.3 Risks Identified in Consumer Behavior

Investopedia found:

Nearly 1 in 5 users lost $100+ after following unverified AI advice.

Reasons include:

AI misunderstanding personal context

Users assuming AI is a certified advisor

Calculation or assumption errors

Lack of disclosure or disclaimer awareness

This highlights the need for controlled, professional-grade AI systems inside firms—not ungoverned public model usage.

2. Insights From Key Industry Sources

Below is a synthesized breakdown of insights from the 8 articles.

2.1 Gies College of Business – Can ChatGPT Give Good Financial Advice?

Key takeaway:

ChatGPT produces understandable, well-structured financial guidance but struggles with prioritization, context understanding, and edge-case calculations.

Implications:

LLMs excel at explanations, not decisions.

Guardrails, templates, and validation layers are essential.

Perfect for portfolio explanations, scenario breakdowns, and FAQs.

2.2 BlackRock – AI Revolution in Retirement

Key takeaway:

AI is improving retirement planning with:

Personalized plan design

Participant engagement

Real-time investment education

Automated reasoning for choices

Implications:

Enterprise financial institutions see LLMs as a strategic differentiator in customer experience.

2.3 World Economic Forum – Modernizing Pension Systems with AI

Key takeaway:

AI can help mitigate the global retirement crisis via:

Adaptive contribution planning

Cost-controlled pension models

Real-time risk monitoring

Personalized communication

Implications:

Retirement systems are shifting from static documentation to dynamic, conversation-driven explanations.

2.4 Britannica – AI for Retirement & Financial Planning

Key takeaway:

AI helps consumers:

Set retirement goals

Estimate savings requirements

Model “what if” scenarios

Explore investment options with clarity

Implications:

Huge consumer demand for LLM-based retirement explainers.

2.5 Investopedia – 1 in 5 Lost Money Using AI Advice

Key takeaway:

Over-reliance on unregulated AI leads to loss.

Many users treat ChatGPT as a certified advisor.

Errors occur in calculations, assumptions, and risk interpretations.

Implication:

Financial firms must build safe AI layers—validated, compliant, and branded—because if they don’t, users will rely on public ChatGPT anyway.

2.6 Harvard Business School – Does AI Help Investors?

Key takeaway:

AI produces rational, structured financial guidance—but investors may misinterpret tone as authoritative.

Implications:

Models should be configured to:

Express uncertainty clearly

Provide factual breakdowns

Avoid unverified recommendations

Include compliance disclaimers

2.7 Mercer – AI & Retirement Plans

Key takeaway:

AI improves:

Benefit communication

Investment route selection

Lifetime income modeling

Macro–micro alignment of retirement portfolios

Implication:

Retirement benefits teams can deploy AI-driven onboarding, education, and planning.

2.8 FinTech Weekly – Optimizing 401(k)s with AI

Key takeaway:

AI changes 401(k) planning from static to dynamic:

Personalized

Data-driven

Updated continuously

Based on market signals and life milestones

Implication:

401(k) providers can deploy conversational bots for ongoing participant engagement.

3. Strategic Opportunities for Firms

3.1 Portfolio-Explanation Engines

LLMs excel at:

Explaining asset allocation

Interpreting risk vs reward

Clarifying fees, ratios, and comparisons

Breaking down historical performance

Translating complex financial jargon into simple language

This is one of the strongest high-value AI use cases.

3.2 Investment FAQ Assistants

Top queries users ask:

“Which is better: index fund or active fund?”

“What is a good expense ratio?”

“Is SIP better than lump sum?”

“Explain this ETF.”

“Why is my portfolio down this month?”

Firms can automate:

FAQ handbooks

Product comparison tools

Prospectus explainers

Risk-profile education flows

3.3 Retirement Planning Co-Pilot

High demand exists for:

Personalized retirement projections

Income-replacement walkthroughs

Social-security integration

Tax-efficient withdrawal strategies

Scenario simulations

AI enables “always-on financial planning.”

3.4 Compliance-Safe Advisor Tools

Advisors themselves want AI to:

Draft explanations

Summarize product options

Create retirement-plan narratives

Prep client reports

Answer routine questions faster

This frees advisors to focus on relationship building, not paperwork.

4. Risk, Governance & Compliance Considerations

4.1 Key risks

Inaccurate numerical assumptions

False confidence tone

Hallucinated facts or data

Users misinterpreting content as licensed advice

Non-compliance with local regulations (FINRA, SEC, FCA, etc.)

4.2 Governance requirements

Firms should implement:

Model guardrails: restricted instructions, disclaimers

Human-in-loop architecture for sensitive topics

Template-based outputs

Logging for audits

Knowledge-grounding using firm-approved content

Scenario-testing for high-risk prompts

4.3 Risk-reduction approaches

Validate numbers with deterministic calculators

Provide multiple-option outputs, not prescriptive directions

Ensure disclaimers are always included

Limit equity-specific recommendations

5. The Future of AI in Financial Advisory (2025–2030)

5.1 Hyper-personalized advisory

Every client receives:

Customized portfolio explanations

Daily insights on their allocation

Real-time reasoning for market shifts

5.2 Integrated retirement ecosystems

AI merges:

Spending data

Savings history

Market predictions

Longevity estimates

to create holistic retirement journeys.

5.3 AI-powered advisory firms

The industry will split into:

Advisor-led companies using AI → efficiency + trust

AI-led companies with advisors → scale + cost advantage

Both models can coexist.

5.4 Regulation will formalize AI advice

Expect new rules around:

AI disclosures

Reasoning transparency

Investment-advice boundaries

Data validation layers

Model certification

6. Conclusion

AI is no longer “experimental” in financial advisory—it is now central to how consumers learn, plan, and make decisions. The eight articles reviewed converge on a single message:

LLMs like ChatGPT are transforming portfolio explanations, investment education, and retirement planning into a dynamic, personalized, conversational experience.

Financial firms that integrate AI early will gain a competitive edge in:

Customer satisfaction

Advisor productivity

Operational efficiency

Regulatory preparedness

Long-term trust building

Those who wait will face an uphill battle as consumers increasingly choose AI-first financial guidance.