Generative-AI Chatbots in Finance & Banking - Account Inquiries • Fraud Alerts • Customer Support

Executive Summary

Banking has already crossed the threshold where AI-driven chat interfaces have become the dominant entry point for customer service. With Bank of America’s Erica surpassing 42 million users and 2+ billion interactions, the industry has proof that conversational interfaces can safely handle high-volume demands for balances, transactions, card issues, and fraud alerts.

The second wave — generative AI chatbots using models like ChatGPT — is accelerating this shift. According to recent surveys, 48% of banking leaders are actively integrating generative AI into customer-facing support, and up to 80% of routine queries can now be automated.

The financial sector is moving toward a world where customer service is real-time, hyper-personalized, and fraud-aware by default.

1. Introduction

Consumers expect banking support to function like their messaging apps — instant, accurate, available 24/7. Traditional call centers and static FAQs fail to keep up with this expectation.

AI chatbots, especially those enhanced with large language models (LLMs) like ChatGPT, now perform:

Account-level inquiries

Card status, payments, transaction lookups

Fraud alerts and suspicious activity verification

Dispute initiation

Standard banking FAQs

Simple product recommendations

Basic onboarding journeys

This whitepaper synthesizes market data, regulatory insights, and leading case studies across the finance & banking sector.

2. Market Landscape: Adoption & Impact

2.1. Scale of Real-World Banking AI Chatbots

Bank of America’s Erica (2024)

42 million+ users

2 billion interactions total

~2 million interactions per day

Source: Bank of America Newsroom (2024)

This shows customer comfort with AI-driven support at scale, long before genAI was mainstream.

2.2. Verified Pre-Generative AI Benchmark (CFPB 2023)

The U.S. Consumer Financial Protection Bureau (CFPB) documented:

32 million customers used banking chatbots by 2022

1 billion+ interactions

Source: CFPB “Chatbots in Consumer Finance” (2023)

Even basic NLP chatbots proved trustworthy for balances, transactions, and account updates.

2.3. Generative AI Adoption by Banks (2024–2025)

According to Google Cloud & Harris Poll:

48% of banking leaders are integrating generative AI into customer-facing chatbots.

Source: Digital Banking Report (2024)

This indicates generative AI is moving from experiment → production.

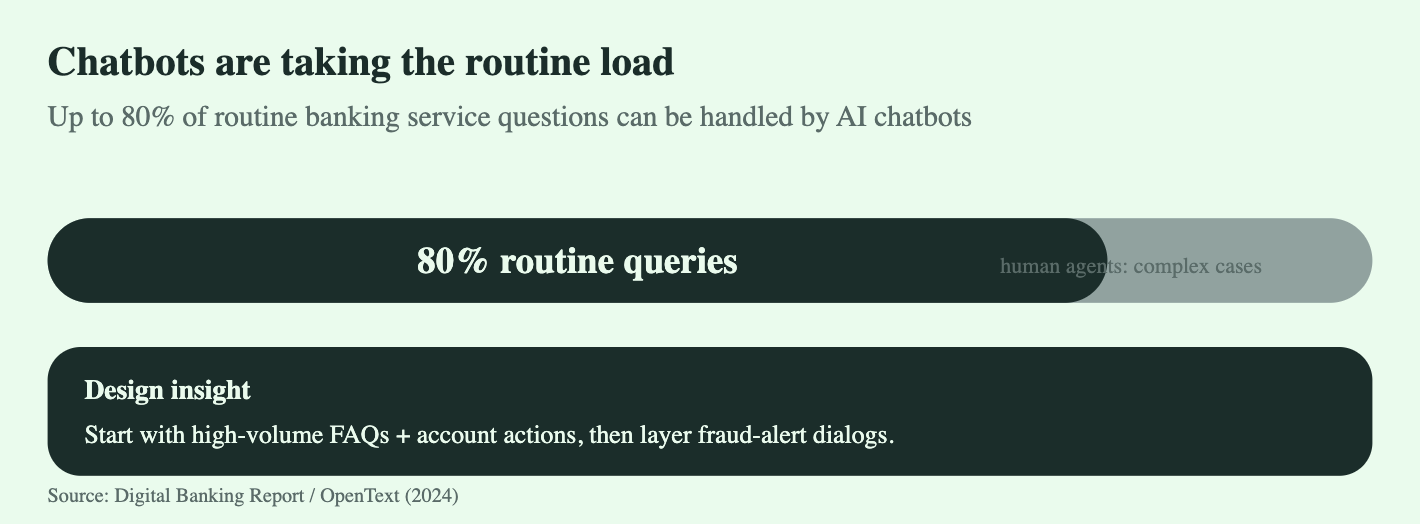

2.4. How Much Work Can AI Chatbots Automate?

Industry consensus from OpenText & Digital Banking Report:

Up to 80% of routine service interactions can be managed by AI chatbots.

This includes:

Account inquiries

Password resets

Transaction lookups

Card status

Basic fraud notifications

Human agents remain essential for complex, multi-step cases.

3. Use Cases: Account Queries, Fraud Alerts, Support

3.1 Account-Level Interactions

Common workflows handled by AI chatbots:

“What’s my balance?”

“Show me yesterday’s transactions.”

“When is my credit card payment due?”

“Download my last statement.”

LLMs significantly improve:

Context retention

Clarifying follow-ups

Transaction reasoning

Multilingual support

3.2 Fraud Alerts & Security

Articles from Tencent Cloud, ThirdEye Data, and IBM highlight AI’s role in fraud prevention:

Fraud-related workflows include:

Real-time suspicious transaction alerts

Customer verification through conversational flows

Automated card freezing/unfreezing

Immediate dispute initiation

Generative AI improves:

The clarity of fraud explanations

Reducing false positives

Conversational authentication

Human-like reassurance during high-stress events

3.3 Dispute Resolution & Support

ChatGPT-powered assistants can:

Gather evidence

Pre-fill forms

Track dispute status

Route to human agents only when required

This reduces resolution time and call-center load.

4. Industry Insights From Articles Reviewed

Below is a synthesis of the 10 articles you provided.

✔ CFPB Report – Chatbots in Consumer Finance

Consumers rely on chatbots for banking basics.

Main complaints: transparency & escalation paths.

Banks must ensure “explainability” and seamless handoff.

✔ Rasa – AI Chatbots in Banking Services

Chatbots now perform advanced tasks: loan FAQs, KYC reminders.

Banks adopting hybrid intent-LLM architecture for safety.

✔ Emerj – Review of Banking Chatbot Applications

Customer expectations rising faster than bank adoption.

Recommendation: “Chatbots should act like a first-line product advisor.”

✔ Tencent Cloud – Chatbots for Anti-Fraud

Conversational bots lower fraud-response time drastically.

They detect behavioral anomalies mid-conversation.

✔ Biz2X & NeonTri Blogs

Banks use bots to reduce cost per interaction by 60–90%.

“Instant replies” and “transaction transparency” boost satisfaction.

✔ Developer/Technical Articles (ResearchGate, ScienceDirect)

Stress on secure LLM deployment

Importance of internal-API orchestration for real-time data

Guidelines for reducing hallucinations

✔ IBM Think – Fraud Detection

Chatbots integrated with fraud-scoring models improve:

Response speed

Customer awareness

Risk containment window

5. System Architecture for GenAI Banking Chatbots

A modern banking chatbot uses a hybrid stack:

Inputs

Customer query (text/voice)

Banking transaction APIs

Fraud detection models

Authentication/ID verification

LLM Layer (ChatGPT or model of choice)

Interpretation of intent

Conversational shaping

Summarizing and explaining banking data

Rewriting fraud alerts in human-friendly tone

Safety Layer

Prompt-guard rails

PII detection

Fin-compliance filters

Bank Core Integration

Account APIs

Transaction history

Message center

Fraud-risk engines

Human Escalation

Smooth escalation when high-risk queries appear

Context handover to agent

6. Benefits for Banks

Operational

Reduce cost per support interaction by 60–90%

24/7 always-on service

Reduced wait times from minutes → seconds

Lower ticket volume

Customer Experience

Clear, human-like explanations

Faster fraud responses

Personalized financial summaries

Multilingual support

Compliance & Fraud

Enhanced monitoring

Conversation logs for audit

Instant suspicious-activity messaging

Soft behavioral checks

7. Risks & Considerations

Model Hallucination Risk

Mitigation:

Retrieval-augmented generation (RAG)

Strict API-only data responses

Domain-specific models

Security

PII encryption

Zero-trust access

Logging & monitoring

Regulatory Considerations

CFPB guidelines

GDPR/Indian DPDP requirements

Audit trails

Human Escalation Gaps

Ensure smooth transitions to agents for:

Complex disputes

High-risk fraud

Regulatory disclosures

8. Future Outlook (2025–2030)

Banks will evolve from simple chatbots to autonomous service layers:

Real-time conversational fraud prevention

Predictive financial guidance

Embedded finance advisory within the chat

Voice + multimodal (“show me my spending breakdown chart”)

Full workflow automation beyond simple Q&A

By 2030, chat interfaces will become the default interaction layer for most banking customers.

9. Conclusion

The banking sector is undergoing a shift driven by generative AI.

Chatbots powered by models like ChatGPT are now capable of:

Handling millions of simultaneous conversations

Providing secure, compliant support

Explaining complex financial data simply

Reducing fraud-response time

Personalizing customer care at scale

The banks that move fast today will define the customer-experience benchmark for the next decade.