Multi-Agent Commerce and Negotiation: Architectures, Game-Theoretic Foundations, and Economic Implications in Autonomous Digital Markets

Abstract

The emergence of multi-agent systems (MAS) is transforming digital commerce by enabling autonomous entities to discover, negotiate, transact, and optimize supply chains without direct human intervention. Multi-agent commerce integrates artificial intelligence, distributed systems, market design, and computational game theory to produce adaptive, scalable, and economically efficient trading ecosystems. This essay synthesizes theoretical foundations, negotiation protocols, system architectures, and real-world implications, while examining trust, mechanism design, and regulatory challenges. It argues that multi-agent commerce represents not merely an automation layer but a structural shift toward machine-mediated market microstructure.

1. Introduction

Digital commerce has evolved through several phases: human-mediated electronic marketplaces, platform-mediated algorithmic pricing, and now agent-mediated autonomous trading ecosystems. In multi-agent commerce, software agents act on behalf of individuals, firms, or other systems to conduct commercial operations including:

Supplier discovery

Price negotiation

Contract formation

Logistics coordination

Risk hedging

Market signaling and arbitrage

Unlike traditional automation, multi-agent commerce introduces strategic autonomy — agents must reason about other agents’ intentions, incentives, and strategies in dynamic, partially observable environments.

2. Conceptual Foundations of Multi-Agent Systems in Commerce

2.1 Definition of Economic Agents

In multi-agent commerce, agents are typically characterized by:

Autonomy – independent decision-making capability

Reactivity – response to environmental changes

Proactivity – goal-directed behavior

Social ability – negotiation, coordination, or competition

Economic agents may represent:

Buyers optimizing utility under budget constraints

Sellers maximizing revenue or market share

Intermediaries optimizing market liquidity or matching efficiency

2.2 System Architectures

Centralized Market Platforms

Agents interact through a centralized exchange or broker

Easier trust enforcement

Lower coordination complexity

Higher platform power concentration

Decentralized Agent Markets

Peer-to-peer negotiation and discovery

Greater resilience and censorship resistance

Higher coordination and trust complexity

Hybrid Federated Markets

Shared protocol layers

Multiple competing marketplaces

Interoperable agent identity and reputation

3. Negotiation Theory in Multi-Agent Commerce

Negotiation is the core operational mechanism of agent commerce.

3.1 Classical Negotiation Models

Bilateral Bargaining

Agents negotiate price and contract terms directly.

Key models:

Nash Bargaining Solution

Rubinstein Alternating Offers Model

Auction-Based Negotiation

Common in agent marketplaces:

English auctions

Dutch auctions

Vickrey auctions

Combinatorial auctions

Agents must optimize:

Bid timing

Information revelation

Strategic bluffing vs transparency

3.2 Automated Negotiation Protocols

Contract Net Protocol

Task announcement → bidding → contract awarding

Efficient for distributed supply chain allocation

Argumentation-Based Negotiation

Agents exchange structured reasoning:

Cost explanations

Risk disclosures

Capability proofs

Multi-Issue Negotiation

Real commerce requires simultaneous optimization of:

Price

Delivery time

Quality guarantees

Service level agreements

3.3 Learning-Driven Negotiation

Modern agents incorporate machine learning:

Reinforcement learning for dynamic bidding

Opponent modeling using Bayesian inference

Meta-learning for cross-market generalization

4. Game-Theoretic Foundations

Multi-agent commerce is fundamentally strategic.

4.1 Mechanism Design

Goal: design market rules where rational agents produce desirable outcomes.

Applications:

Incentive-compatible pricing

Truthful reporting systems

Fraud-resistant marketplaces

4.2 Equilibrium Concepts

Nash Equilibrium

Agents converge to stable strategies given others’ strategies.

Bayesian Nash Equilibrium

Used when agents have incomplete information.

Evolutionary Stability

Relevant in long-running digital ecosystems.

4.3 Computational Game Theory Challenges

Strategy spaces are extremely high dimensional

Agents may adapt faster than equilibrium convergence

Emergent collusion risk in learning agents

5. Trust, Identity, and Reputation

Trust is the limiting factor in autonomous commerce.

5.1 Identity Layers

Cryptographic identity

Behavioral identity

Institutional identity

5.2 Reputation Systems

Signals include:

Transaction reliability

Contract fulfillment rate

Dispute resolution outcomes

5.3 Verifiable Credentials

Agents may prove:

Regulatory compliance

Supply chain provenance

ESG certifications

6. Economic Implications

6.1 Market Efficiency

Potential gains:

Reduced transaction costs

Real-time price discovery

Supply-demand matching precision

6.2 Market Microstructure Transformation

Markets may shift toward:

Continuous micro-negotiation

Personalized pricing equilibrium

Dynamic contract formation

6.3 Labor and Organizational Impact

Likely shifts:

Procurement automation

Autonomous supply chain orchestration

AI-mediated B2B relationship management

Human roles shift toward:

Strategy

Governance

Exception handling

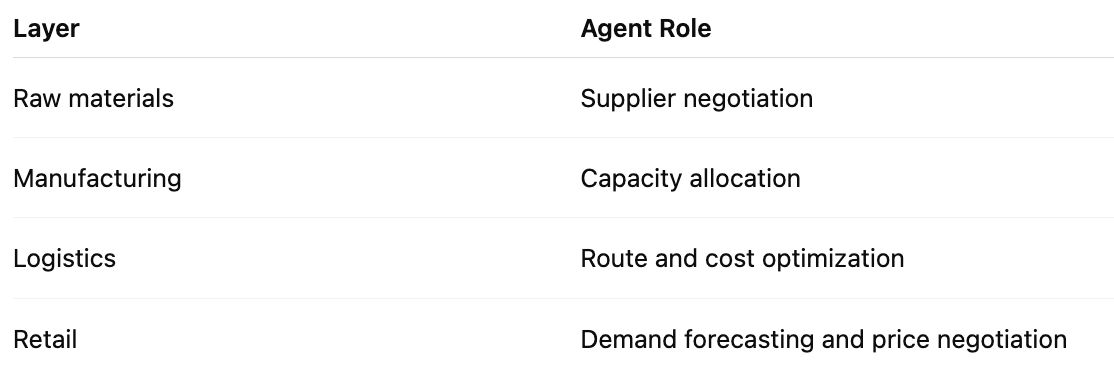

7. Multi-Agent Supply Chain Negotiation

Agents coordinate across multiple layers:

Key innovation: end-to-end autonomous contracting loops

8. Regulatory and Ethical Challenges

8.1 Liability Attribution

Who is responsible when:

An agent commits fraud?

An agent forms illegal price agreements?

8.2 Algorithmic Collusion

Learning agents may discover tacit collusion strategies without explicit coordination.

8.3 Market Fairness

Risks:

Data monopolies

Strategic manipulation by super-intelligent agents

Access inequality between firms

9. Technical Challenges

9.1 Interoperability

Need for:

Standard negotiation languages

Cross-market contract schemas

Shared ontologies

9.2 Scalability

Future markets may involve:

Billions of negotiating agents

Millisecond contract cycles

9.3 Explainability

Regulators and firms require:

Transparent negotiation reasoning

Auditable decision trails

10. Future Research Directions

10.1 Autonomous Market Design

Markets that self-optimize rules via meta-learning.

10.2 Self-Evolving Negotiation Strategies

Agents that invent new negotiation protocols.

10.3 Human-Agent Economic Collaboration

Hybrid decision markets combining human intuition and agent optimization.

10.4 Agent-to-Agent Legal Frameworks

Machine-interpretable law and automated compliance enforcement.

11. Conclusion

Multi-agent commerce represents a structural transition from platform capitalism to protocol-mediated autonomous markets. Negotiation becomes continuous, personalized, and computationally optimized. While economic efficiency gains are likely substantial, risks related to systemic coordination, market fairness, and governance require new interdisciplinary regulatory approaches.

The long-term trajectory suggests a world in which markets operate as self-regulating computational ecosystems, where humans define objectives and ethical boundaries while agents execute economic activity at machine timescales. The central question will not be whether agents can negotiate effectively, but whether societies can design institutions capable of governing machine-driven market intelligence.