Multi-Agent Commerce in an Era of Global Tariffs, Economic Conflict, and Kinetic Warfare

Abstract

The convergence of artificial intelligence (AI), geopolitical fragmentation, and economic securitization is reshaping global commerce. Multi-agent commerce systems—networks of autonomous AI agents coordinating procurement, logistics, pricing, compliance, and market strategy—are emerging as critical infrastructure for firms navigating tariff regimes, sanctions, supply chain disruptions, and active military conflicts. This essay examines the theoretical foundations, technical architectures, economic implications, and geopolitical risks of multi-agent commerce under conditions of tariff escalation, economic warfare, and conventional armed conflict. It argues that multi-agent commerce will transition from efficiency optimization to resilience maximization, fundamentally altering how global trade networks are organized and governed.

1. Introduction: From Globalization to Fragmented Interdependence

The late 20th and early 21st centuries were defined by hyper-globalization: supply chains optimized for cost, just-in-time inventory, and centralized decision intelligence. However, three overlapping forces have disrupted this paradigm:

Tariff proliferation and trade blocs

Economic warfare (sanctions, export controls, financial exclusion)

Hot conflicts affecting trade corridors and production zones

Traditional enterprise systems cannot respond fast enough to multi-variable shocks across jurisdictions. Multi-agent commerce systems emerge as a computational response to geopolitical complexity, enabling distributed, adaptive, and semi-autonomous economic decision-making.

2. Defining Multi-Agent Commerce

Multi-agent commerce refers to distributed AI agents representing different commercial functions or stakeholders, interacting through negotiated protocols to optimize outcomes under constraints.

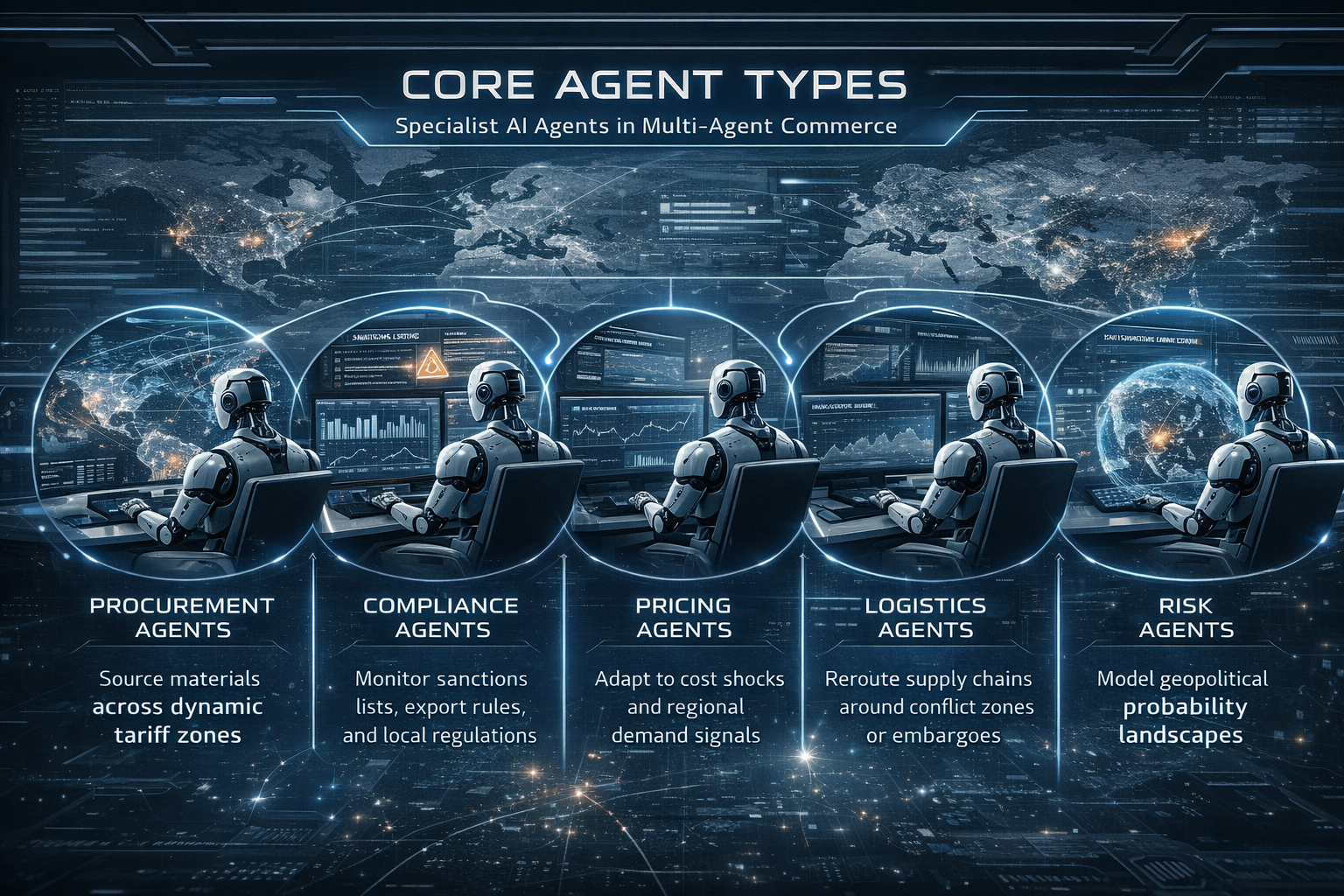

2.1 Core Agent Types

Procurement agents — source materials across dynamic tariff zones

Compliance agents — monitor sanctions lists, export rules, and local regulations

Pricing agents — adapt to cost shocks and regional demand signals

Logistics agents — reroute supply chains around conflict zones or embargoes

Risk agents — model geopolitical probability landscapes

Unlike monolithic ERP systems, multi-agent commerce is:

Decentralized

Self-negotiating

Event-reactive

Scenario-simulating

3. Theoretical Foundations

3.1 Complex Adaptive Systems

Global commerce resembles an ecological system. Multi-agent frameworks mirror biological distributed intelligence (e.g., ant colony optimization), allowing emergent equilibrium under volatile conditions.

3.2 Mechanism Design and Game Theory

Agents must operate under conflicting incentives:

Firms vs regulators

Exporters vs importers

Allies vs adversaries

Auction theory, Nash equilibria, and contract theory are embedded into agent negotiation layers.

3.3 Information Asymmetry Reduction

Multi-agent systems reduce latency between signal detection (e.g., tariff change) and economic response (e.g., supplier shift), compressing decision cycles from weeks to minutes.

4. Tariffs as Machine-Readable Economic Terrain

Historically, tariffs were static policy artifacts. In multi-agent commerce, tariffs become dynamic machine-interpreted constraints.

4.1 Real-Time Tariff Arbitrage

Agents continuously:

Compare landed cost across jurisdictions

Simulate tariff scenario forecasts

Shift sourcing micro-incrementally

4.2 Tariff Cascades

Tariffs in one sector propagate across supply chains. Agents can model second- and third-order effects faster than human trade analysts.

4.3 Digital Customs Negotiation

Future customs clearance may involve:

Agent → Customs AI → Port logistics AI negotiation loops.

5. Economic Warfare and Algorithmic Trade Strategy

Economic warfare introduces non-linear constraints:

Sudden sanctions

Entity blacklisting

Technology export bans

Financial network exclusions

5.1 Autonomous Compliance Enforcement

Compliance agents can:

Instantly freeze transactions with restricted entities

Rebuild supplier networks within minutes

Generate audit trails for regulators

5.2 Sanctions Evasion Detection (and Counter-Detection)

State actors will deploy competing agent systems:

Enforcement AI

Evasion AI

Attribution AI

This creates an algorithmic economic arms race.

6. Multi-Agent Commerce During Active War

When physical conflict disrupts infrastructure, multi-agent systems shift from cost optimization to survival optimization.

6.1 Dynamic Supply Chain Rerouting

Agents integrate:

Satellite data

Insurance risk feeds

Military conflict mapping

Energy price volatility

6.2 Production Migration Automation

Factories may become “digitally portable”:

Agents coordinate:

Equipment relocation

Workforce contracting

Local compliance onboarding

6.3 Strategic Stockpile Optimization

Rather than static reserves, agents maintain rolling strategic inventories based on probabilistic conflict models.

7. Corporate Sovereignty and the Rise of AI Trade Diplomacy

Large corporations may effectively operate as AI-mediated quasi-states:

Negotiating tariff classifications

Structuring cross-border value chains

Influencing local industrial policy

Multi-agent commerce could lead to:

Corporate-state hybrid negotiation protocols

Automated trade dispute simulation

Algorithmic treaty impact modeling

8. Risks and Failure Modes

8.1 Algorithmic Escalation

If national trade AIs optimize aggressively, they could trigger:

Rapid tariff retaliation spirals

Supply chain weaponization

Financial market flash collapses

8.2 Data Weaponization

Agents rely on data streams vulnerable to:

Disinformation injection

Market signal spoofing

Synthetic economic intelligence

8.3 Concentration Risk

If only major powers and mega-firms deploy advanced systems, smaller economies become structurally dependent.

9. Governance and Regulatory Futures

Potential regulatory frameworks include:

9.1 AI Trade Transparency Standards

Mandating:

Decision explainability

Audit logs

Compliance traceability

9.2 Multi-National Agent Protocol Agreements

Equivalent to air traffic control rules — but for trade algorithms.

9.3 Digital Geneva Conventions for Economic AI

Potential limits on:

Civilian supply chain targeting

Food and medicine algorithmic blockades

10. Future Trajectories (2026–2040)

Near Term (0–5 years)

Enterprise multi-agent orchestration platforms

Automated tariff intelligence feeds

AI compliance co-pilots

Mid Term (5–10 years)

Autonomous cross-border contracting agents

AI-mediated trade negotiations

Real-time global supply chain digital twins

Long Term (10–20 years)

National economic AI coordination layers

Autonomous global trade equilibrium systems

Machine-negotiated tariff treaties

Conclusion

Multi-agent commerce represents a structural evolution of global trade governance from human-paced bureaucracy to machine-paced adaptive networks. In an era defined by tariffs, economic warfare, and kinetic conflict, competitive advantage will shift from lowest cost production to highest adaptive intelligence.

The central paradox is that while multi-agent commerce can stabilize trade under extreme volatility, it may also accelerate geopolitical economic competition into algorithmic escalation cycles. The future of global commerce may therefore depend less on individual corporate strategy and more on how states, corporations, and international institutions coordinate the rules governing autonomous economic agents