Multi-Agent Commerce in Financial Services: Architectures, Control Loops, and Emergent Decision Economies

Multi-agent commerce represents a paradigm shift in financial services where distributed, specialized AI agents collaboratively execute complex economic workflows across banking, lending, and wealth management ecosystems. Unlike traditional rule-based automation or single-model decision systems, multi-agent financial orchestration enables continuous negotiation between regulatory constraints, risk evaluation, customer intent inference, and product optimization. This essay examines the architectural topology, complexity drivers, agent graph dynamics, and non-linear decision paths of multi-agent commerce in financial services, proposing a control-theoretic and socio-technical framework for safe deployment at scale.

1. Introduction: From Linear Pipelines to Economic Agent Networks

Financial services decision-making has historically been hierarchical, document-driven, and human approval–gated. However, increasing regulatory pressure, real-time fraud threats, and hyper-personalized financial product expectations have exceeded the capacity of linear automation.

Multi-agent commerce introduces:

Distributed cognition across specialized agents

Continuous feedback loops instead of stage-gate approvals

Dynamic negotiation between risk, compliance, and customer value

Event-driven rather than application-driven financial flows

The shift is not merely technical but institutional, redefining how trust, liability, and authority are encoded in software.

2. Primary Complexity Drivers in Financial Multi-Agent Systems

2.1 Regulatory Compliance as a Real-Time Constraint Field

Financial regulation is not static validation — it is contextual constraint enforcement across time, jurisdiction, and product class.

Multi-agent systems must simultaneously evaluate:

Jurisdictional regulatory overlays

Customer risk class changes

Transaction pattern evolution

Product-specific regulatory logic

This transforms compliance from a checkpoint into a continuous control signal inside the agent graph.

2.2 Risk Scoring Feedback Loops

Traditional credit scoring is episodic. Multi-agent commerce introduces:

Streaming behavioral signals

Continuous fraud surface evaluation

Adaptive credit limit modeling

Real-time affordability recomputation

Risk becomes a state variable, not a pre-transaction gate.

2.3 Multi-Party Approval Graphs

Financial decisions often require simultaneous approval from:

Risk

Compliance

Product policy

Capital allocation models

Sometimes external counterparties

Multi-agent orchestration replaces static approval chains with consensus graphs.

2.4 Long Decision Cycles with Event Re-Entry

Mortgages, structured lending, and wealth transitions may span months or years. Agents must support:

Decision pause/resume

Context persistence across life events

Re-underwriting triggered by external signals

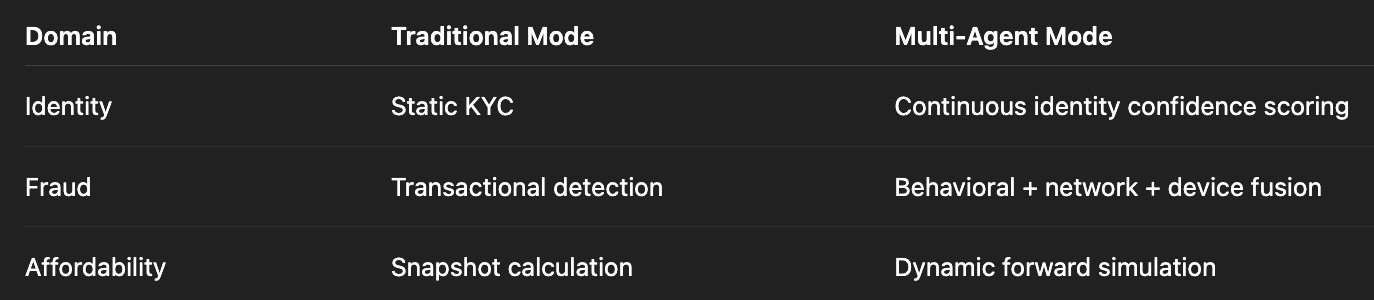

2.5 Identity–Fraud–Affordability Coupling

These dimensions are traditionally siloed but become tightly linked:

3. Canonical Agent Graph Architecture

Discovery

↓

Financial Profiling

↓

Risk + Compliance Validation

↓

Offer Structuring

↓

Transaction Execution

↓

Lifecycle Support + Advisory

This graph is conceptual, not strictly sequential. In production, edges are bidirectional and state-aware.

4. Expanded Agent Set: Functional Deep Dive

4.1 Customer Intent Agent

Core Capabilities

Latent financial goal inference

Life-event signal interpretation

Stress vs opportunity classification

Research Frontier

Probabilistic intent modeling using temporal behavior embeddings and macroeconomic context injection.

4.2 Financial Profile Agent

Constructs

Income stochastic modeling

Cash flow forward simulation

Debt capacity stress testing

Key Innovation

Moves from static affordability to scenario-space solvency envelopes.

4.3 Risk Agent

Multi-Modal Inputs

Bureau data

Behavioral telemetry

Network graph risk

Device fingerprinting

Emerging Direction

Risk as a continuously updated posterior probability distribution, not a score.

4.4 Compliance Agent

Operational Domains

KYC identity verification

AML transaction monitoring

Sanctions list matching

Product suitability enforcement

Hard Problem

Explaining probabilistic compliance decisions to regulators and auditors.

4.5 Offer Structuring Agent

Optimization Surface

Price elasticity

Default probability curve

Customer lifetime value

Capital efficiency

Mathematical Framing

Multi-objective constrained optimization under regulatory boundary conditions.

4.6 Lifecycle Advisory Agent

Continuous Responsibilities

Refinance opportunity detection

Portfolio rebalance triggers

Financial stress early warning

Cross-product migration pathways

This agent transforms financial services from transactional to relationship-computational.

5. Non-Linear Execution Paths

5.1 Stress Trigger Path

Support → Financial Profiling → Offer Structuring → TransactionTriggered by:

Income shock detection

Overdraft cascade signals

Behavioral financial distress markers

Here, customer preservation overrides revenue optimization.

5.2 Regulatory Intervention Path

Transaction → Compliance → Validation → TransactionTriggered by:

Suspicious transaction patterns

Jurisdictional threshold breaches

Sanctions list updates

This requires transaction suspension with reversible execution states.

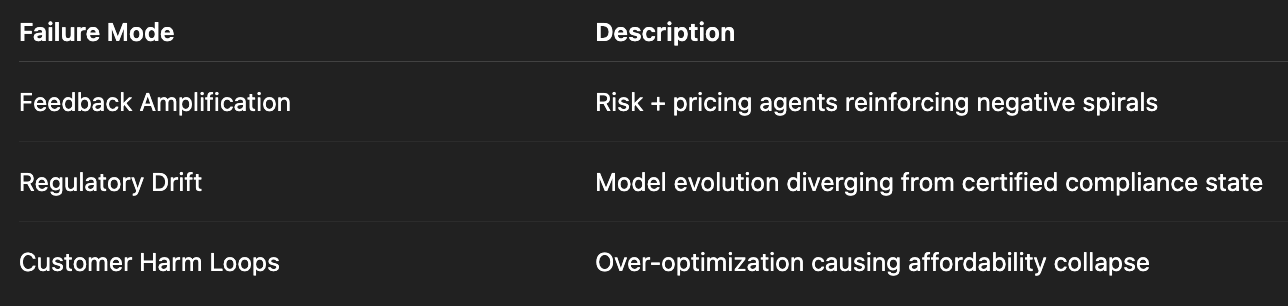

6. Control Theory Perspective

Multi-agent finance systems resemble distributed adaptive control systems with:

State observers (profiling agents)

Constraint enforcers (compliance agents)

Optimization controllers (offer agents)

Stability monitors (risk agents)

Key Stability Risks:

7. Governance and Safety Framework

7.1 Agent Explainability Requirements

Each agent must expose:

Decision provenance

Feature influence mapping

Counterfactual explanation capability

7.2 Simulation Sandboxes

Before deployment:

Synthetic population testing

Regulatory scenario stress testing

Black swan liquidity simulations

7.3 Human-in-the-Loop Design

Humans shift from decision-makers to:

Boundary condition setters

Exception adjudicators

Ethical escalation authorities

8. Economic Implications

8.1 Financial Products Become Dynamic Services

Interest rates, limits, and terms become continuously personalized streams.

8.2 Collapse of Product Silos

Loans, insurance, and investments converge into financial state management platforms.

8.3 Emergence of Autonomous Financial Negotiation

Agents will negotiate:

Between institutions

Between customer and institution

Between regulatory frameworks

9. Open Research Questions

How to formally verify compliance in self-modifying agent systems?

How to prevent emergent bias across interacting agent learning loops?

How to allocate liability in distributed autonomous financial decisions?

Can multi-agent financial systems be made regulator-observable in real time?

10. Conclusion

Multi-agent commerce in financial services represents a shift from process automation to economic cognition infrastructure. The key challenge is not technical feasibility but institutional trust encoding — embedding law, ethics, and systemic stability into continuously learning, distributed decision networks.

The future financial institution will not be a system of record — it will be a system of negotiated financial reality, mediated by interacting intelligent agents operating under dynamic regulatory and economic constraints.