The Predictive Intelligence Flywheel: A Generalized Business Model for Compounding Economic Advantage Through Data, Prediction, and AI

A new class of firms has emerged whose primary competitive advantage does not derive from physical assets, proprietary algorithms alone, or traditional network effects, but from the compounding interaction between behavioral data, predictive modeling, and economic optimization. This essay formalizes this architecture as the Predictive Intelligence Flywheel (PIF), a generalized, sector-agnostic business model in which firms continuously collect behavioral data, convert it into predictive intelligence through machine learning systems, deploy predictions to optimize decisions, and thereby improve economic outcomes for users and the platform itself. These improved outcomes increase usage, generating additional behavioral data and reinforcing the cycle. This creates a compounding, self-reinforcing system that produces increasing returns to scale, durable competitive moats, and structural economic defensibility. Using RedCloud as a primary example, and extending across sectors including finance, logistics, healthcare, manufacturing, and software platforms, this essay demonstrates that the Predictive Intelligence Flywheel is rapidly becoming the dominant architecture for value creation in the AI economy.

I. Introduction: From Software Platforms to Intelligence Platforms

Historically, firms created value by producing goods, delivering services, or enabling transactions. In the digital era, platform companies created value by facilitating interactions between participants, generating network effects. However, the Predictive Intelligence Flywheel represents a further evolutionary step: firms no longer merely facilitate transactions—they optimize them.

In this model, the firm becomes an intelligence layer embedded in economic activity. It continuously observes behavioral data, predicts future outcomes, and influences decisions in ways that improve efficiency, profitability, and risk management.

The core shift is conceptual:

Traditional firms execute decisions.

Predictive Intelligence Flywheel firms improve decisions.

This distinction is economically profound. Decision quality directly determines economic efficiency. Firms that systematically improve decisions across millions of actors can capture enormous economic surplus.

II. Formal Definition of the Predictive Intelligence Flywheel

The Predictive Intelligence Flywheel is a self-reinforcing system consisting of five core stages:

Behavioral Data Generation

Predictive Modeling

Decision Optimization

Economic Value Creation

Increased Platform Dependence and Data Generation

This forms a continuous feedback loop:

Data → Prediction → Decision → Outcome → More Data

Each iteration strengthens prediction accuracy and economic value.

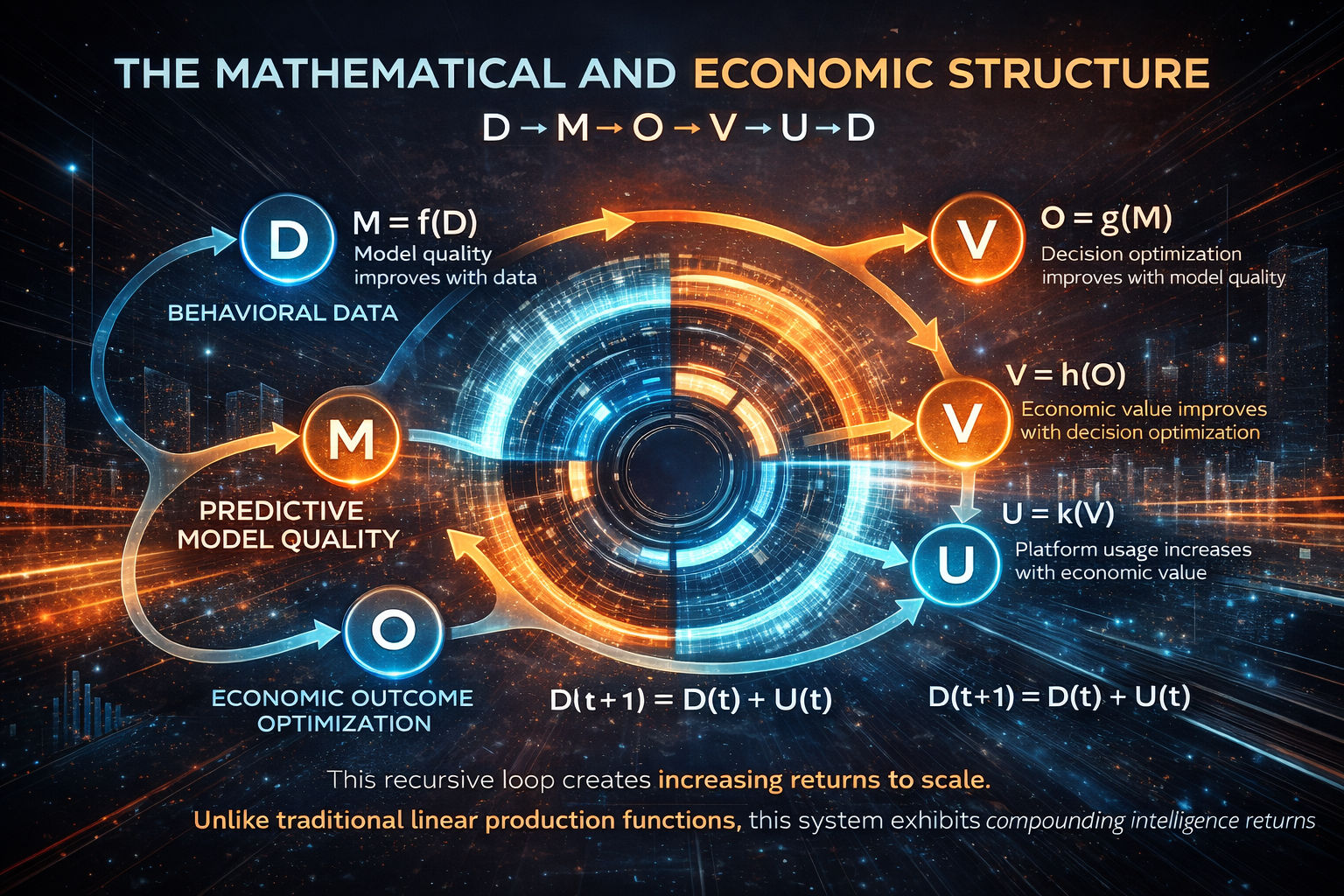

III. The Mathematical and Economic Structure

Let:

D represent behavioral data

M represent predictive model quality

O represent economic outcome optimization

U represent platform usage

V represent economic value captured by the platform

The flywheel evolves according to the following functional relationships:

Model quality improves with data:

M = f(D)

Decision optimization improves with model quality:

O = g(M)

Economic value improves with decision optimization:

V = h(O)

Platform usage increases with economic value:

U = k(V)

Data increases with platform usage:

D(t+1) = D(t) + U(t)

Substituting recursively produces:

D → M → O → V → U → D

This recursive loop creates increasing returns to scale.

Unlike traditional linear production functions, this system exhibits compounding intelligence returns.

IV. RedCloud as a Canonical Example

RedCloud operates a commerce platform connecting informal retailers with suppliers. Traditionally, retailers order inventory based on intuition, incomplete information, or simple heuristics. This produces inefficiencies including stockouts, overstocking, and suboptimal capital allocation.

RedCloud collects behavioral transaction data, including:

Order frequency

SKU demand patterns

Basket composition

Payment and credit behavior

Using machine learning models, RedCloud predicts:

What retailers will order

When they will order

How much they will order

Their credit risk

These predictions enable intelligent ordering recommendations.

Retailers experience improved economic outcomes:

Increased sales

Reduced stockouts

Improved capital efficiency

These improved outcomes increase retailer dependence on the platform, generating more transaction data.

This strengthens model performance and reinforces the flywheel.

This system transforms RedCloud from a transaction platform into an intelligence platform.

V. Generalization Across Sectors

The Predictive Intelligence Flywheel is not specific to commerce. It is a generalizable economic architecture.

A. Finance: Visa, Mastercard, and Stripe

Payment networks observe transaction behavior across millions of merchants.

They predict:

Fraud risk

Creditworthiness

Transaction anomalies

Improved fraud detection reduces financial losses.

Reduced losses increase platform trust and adoption.

More transactions generate more behavioral data.

This improves prediction accuracy.

Stripe exemplifies this architecture through its fraud detection system Radar, which improves continuously through network-wide data.

B. Transportation and Logistics: Uber

Uber collects real-time data on:

Rider demand

Driver availability

Geographic movement patterns

Machine learning models predict:

Demand surges

Optimal pricing

Optimal driver allocation

This improves system efficiency.

Shorter wait times increase user satisfaction.

Increased usage generates more data.

This strengthens prediction quality.

Uber becomes increasingly efficient with scale.

C. Manufacturing: Tesla

Tesla vehicles continuously generate telemetry data including:

Driver behavior

Road conditions

Vehicle performance

Tesla uses this data to improve autonomous driving models.

Improved autonomy increases vehicle safety and usability.

More vehicles generate more data.

This strengthens Tesla’s predictive capabilities.

This creates a self-reinforcing intelligence advantage over competitors.

D. Healthcare: Precision Medicine Platforms

Healthcare platforms collect patient data including:

Diagnostic imaging

Genetic data

Treatment outcomes

Machine learning models predict optimal treatment strategies.

Improved treatment outcomes increase adoption.

More patient data improves model accuracy.

This accelerates medical advancement.

E. Software Platforms: Amazon

Amazon collects behavioral data including:

Search queries

Purchase behavior

Click behavior

Amazon predicts:

Product demand

Customer preferences

Inventory allocation

This improves recommendation accuracy.

Improved recommendations increase purchases.

More purchases generate more data.

This strengthens Amazon’s predictive advantage.

VI. Economic Implications: Increasing Returns to Intelligence

Traditional industries exhibit diminishing returns to scale.

Factories eventually saturate capacity.

Labor productivity plateaus.

However, Predictive Intelligence Flywheel firms exhibit increasing returns to intelligence.

More scale produces better predictions.

Better predictions produce better economic outcomes.

Better outcomes produce more scale.

This creates superlinear growth dynamics.

This explains the extreme dominance of AI-native firms.

VII. Defensibility and Competitive Moats

The Predictive Intelligence Flywheel creates several forms of defensibility:

1. Data Network Effects

Prediction accuracy improves with proprietary behavioral data.

Competitors cannot replicate historical behavioral data.

This creates structural barriers to entry.

2. Switching Costs

Users become economically dependent on predictive insights.

Switching reduces decision quality.

This creates economic lock-in.

3. Model Advantage Compounding

Models improve continuously.

Competitors starting later face structural disadvantages.

This creates compounding intelligence asymmetry.

4. Integration into Economic Workflows

The platform becomes embedded in operational decision-making.

This creates operational dependence.

VIII. Transition from Transaction Platforms to Decision Platforms

Traditional platforms facilitate transactions.

Predictive Intelligence Flywheel firms optimize decisions.

This distinction is critical.

Decision quality determines economic efficiency.

Firms that systematically improve decisions capture increasing economic value.

The firm becomes not merely infrastructure, but intelligence infrastructure.

IX. Organizational and Technical Requirements

Successful implementation requires several architectural components:

Unified behavioral data infrastructure

Feature stores capturing behavioral signals

Machine learning training pipelines

Prediction services

Continuous feedback loops

These components enable continuous intelligence improvement.

X. Long-Term Evolution: Autonomous Economic Systems

The ultimate evolution of the Predictive Intelligence Flywheel is autonomous optimization.

Systems will continuously:

Observe behavior

Predict outcomes

Optimize decisions

Learn from results

This produces self-optimizing economic systems.

Human decision-making becomes increasingly augmented or replaced by machine intelligence.

XI. Macroeconomic Implications

The Predictive Intelligence Flywheel fundamentally restructures competitive dynamics.

Economic advantage shifts from asset ownership to intelligence ownership.

Firms with superior behavioral data and predictive systems dominate markets.

This creates winner-take-most market structures.

This explains the dominance of firms such as Amazon, Google, Tesla, and emerging firms like RedCloud.

XII. Conclusion

The Predictive Intelligence Flywheel represents a new generalized business model in which economic value is created through continuous improvement of decision quality via behavioral data and machine learning.

Unlike traditional firms, which scale through physical assets or labor, Predictive Intelligence Flywheel firms scale through intelligence accumulation.

This creates increasing returns to scale, durable competitive moats, and structural economic advantage.

RedCloud exemplifies this architecture in commerce, just as Tesla does in transportation, Stripe in finance, and Amazon in retail.

The Predictive Intelligence Flywheel is not merely a technological innovation.

It is a new economic architecture.

It represents the dominant form of value creation in the intelligence economy.