Multi-Agent Systems (MAS): Unit Economics, Margin Expansion, and Valuation Potential

Executive Thesis

Multi-Agent Systems (MAS) represent the transition from software as a tool to software as an autonomous labour layer. For investors, the core unlock is not model capability — it is unit economics leverage. MAS businesses, when designed correctly, combine SaaS-like recurring revenue with services-like outcome monetisation, while asymptotically driving marginal costs toward zero through automation, model optimisation, and economic routing.

The result is a potential new category of software companies capable of sustaining 70–90% long-term gross margins, expanding revenue per customer without linear headcount growth, and building durable competitive moats through data flywheels and workflow lock-in.

1. Why MAS Unit Economics Are Structurally Different

Traditional software monetises:

Seats

Licenses

API calls

Storage or compute

MAS monetises:

Decisions

Workflows

Outcomes

Automated labour hours

This changes the economic model from software productivity enhancement to software labour replacement and augmentation.

Key shift:

Legacy SaaSMASSeat-based valueOutcome-based valueFeature adoption growthWorkflow automation expansionHuman productivity multiplierHuman labour substitutionUsage cost = hostingUsage cost = reasoning + execution

2. Core MAS Unit Economics Drivers

Revenue Drivers

Platform subscription (infrastructure + governance + orchestration)

Workflow or automation transaction pricing

Outcome-based performance fees

Managed automation services

Cost Drivers

Model inference (tokens / reasoning loops)

Tool execution (APIs, RPA, data services)

Memory + retrieval infrastructure

Orchestration compute + telemetry

Human-in-the-loop oversight (declines over time)

3. The MAS Margin Expansion Flywheel

MAS companies have an unusually powerful margin flywheel:

Stage 1 — Early Deployment

Higher costs due to:

Premium model usage

Over-reasoning

Safety redundancy

Human review layers

Gross Margin: ~40–60%

Stage 2 — Optimisation

Costs drop via:

Model routing

Reasoning step pruning

Tool call optimisation

Caching and memory reuse

Gross Margin: ~60–75%

Stage 3 — Economic Autonomy

Agents actively optimise cost:

Cheapest viable model selection

Early exit decisioning

Cost-aware planning

Dynamic workflow path selection

Gross Margin: ~75–90%

4. The Most Important MAS Metric: Cost Per Outcome

Investors should focus on:

Cost Per Business Outcome Examples:

Cost per qualified lead

Cost per fraud case resolved

Cost per research report generated

Cost per compliance audit completed

This metric is superior to:

Token cost

Model cost

Infrastructure cost

Because customers buy outcomes, not compute.

5. MAS Revenue Expansion Dynamics

Unlike SaaS seat expansion, MAS expands via:

Horizontal Expansion

More workflows automated across departments.

Vertical Depth Expansion

More decision steps automated inside workflows.

Outcome Value Expansion

Higher value decisions shift from human → MAS.

This often produces net revenue retention > 130–160% in successful deployments.

6. MAS Cost Compression Mechanisms (Investor Moat)

Strong MAS companies build defensible cost advantages via:

Model Portfolio Optimisation

Dynamic routing across:

Premium reasoning models

Mid-tier task models

Cheap classification models

Workflow Intelligence

Learning optimal reasoning depth per task type.

Data & Memory Flywheels

More data → fewer reasoning steps → lower cost.

FinOps-Aware Planning

Agents choose lowest cost viable path automatically.

7. Why MAS Can Support Premium Valuation Multiples

A. Recurring + Consumption Hybrid Revenue

Combines SaaS predictability with usage upside.

B. High Switching Costs

MAS integrates deeply into:

Business workflows

Knowledge graphs

Internal systems

Compliance processes

C. Data Network Effects

More usage → better optimisation → lower cost → higher margin → price power.

D. Labour Market Arbitrage

MAS captures value from:

Replaced FTE cost

Reduced outsourcing cost

Faster decision cycles

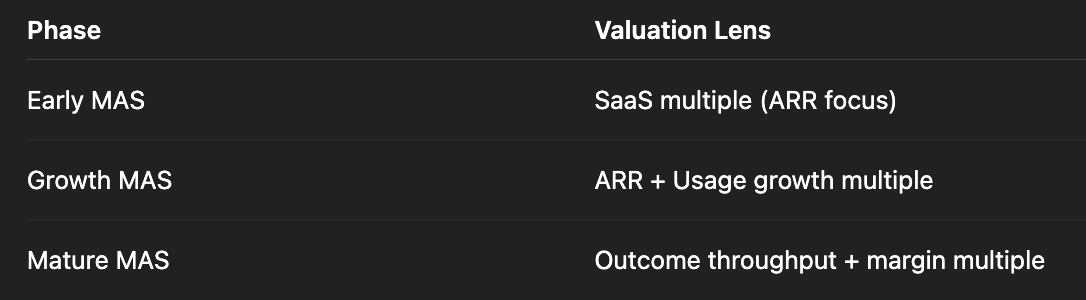

8. Comparable Valuation Evolution (Forward Looking)

Market likely evolves:

Long-term: MAS leaders likely trade closer to mission-critical infrastructure + workflow OS multiples.

9. Key Risks Investors Must Underwrite

Model Cost Volatility

Mitigated by multi-model routing and abstraction layers.

Over-Automation Risk

Poor governance → runaway cost or quality degradation.

Customer Cost Predictability Concerns

Requires strong FinOps + guardrails.

Vendor Dependency Risk

Solved via orchestration abstraction and model marketplaces.

10. The Most Attractive MAS Verticals (Near-Term)

Strongest economics occur where:

ROI is measurable

Decisions are repeatable

Labour cost baseline is high

Compliance burden is high

Top categories:

Compliance automation

Fraud detection and prevention

Revenue optimisation

Security operations

Procurement intelligence

Insurance claims processing

11. The Long-Term Strategic Upside

The highest-value MAS companies will become:

Decision infrastructure providers

Enterprise economic optimisation engines

Autonomous workflow operating systems

These companies will capture:

Software margin profiles

Services TAM scale

Data network effect defensibility

12. Investor Bottom Line

MAS is not just “AI SaaS.”

It is the first credible category where software:

Executes complex work

Improves economically over time

Expands margin as adoption increases

Scales revenue without linear labour growth

The winning MAS companies will be those that treat economics as a first-class system input, not just a financial output.

DM me to get access to MAS Economics, a lightweight application designed to provide real-time cost visibility, cost forecasting, and runtime budget guardrails for multi-agent workflows. It is intended to be the first deployable wedge product in a broader MAS economic control platform.

Platform Capabilities Overview

Our platform helps organisations understand, control, and optimise the economics of AI and multi-agent systems (MAS) — moving from simple cost visibility to fully autonomous economic optimisation.

Economic Visibility (Foundation)

Goal: Help you see exactly where AI money is going — and why.

At this stage, we connect to your AI systems, capture activity data, and turn it into clear financial insight.

What you get:

MAS Telemetry Ingestion Captures detailed activity and resource usage from every agent and model interaction.

Cost Attribution Engine Shows exactly which teams, agents, or workflows are driving cost — so you can bill accurately and optimise spend.

Unit Economics Dashboards Real-time visibility into metrics like cost per task, cost per customer outcome, and system financial health.

Cost Maturity Scoring Benchmarks your AI efficiency against industry standards and best practices.

Forecast Modeling Predicts future AI spend and resource demand based on historical patterns.

Pricing Simulation Lets you test “what-if” scenarios (e.g., model changes, workflow logic changes) before making decisions.

Customer Outcome: 👉 Full transparency into AI costs 👉 Ability to predict spend 👉 Confidence in financial reporting

Economic Control (Governance)

Goal: Move from insight to active cost management.

Once you can see costs clearly, this phase gives you real-time control and protection.

What you get:

Real-time Budget Enforcement Automatic stops or alerts when spending approaches limits.

Cost Guardrail Policies Rules that prevent inefficient agent behaviour or unnecessary expensive model usage.

Model Routing Optimisation Automatically selects the most cost-effective model for each task while maintaining quality.

Token Futures & Budget Pools Allocate reserved or prepaid AI capacity across teams and workloads.

Cost Pressure Signals Agents receive real-time signals when pricing conditions change — enabling instant adaptation.

Customer Outcome: 👉 Prevent runaway AI costs 👉 Automate financial governance 👉 Maintain performance while reducing spend

Economic Intelligence (Agent Autonomy)

Goal: Make AI systems financially intelligent — not just functional.

Here, agents start making decisions based on value vs. cost trade-offs.

What you get:

Economic Decision Scoring Measures how financially smart each agent action is.

Cost-aware Planning Algorithms Agents plan tasks while actively optimising for cost efficiency.

ROI-based Workflow Routing Workflows are prioritised based on expected return on investment.

Self-throttling MAS Low-priority work automatically slows or pauses during expensive periods.

Cost-aware Negotiation Agents can bid for resources or trade capacity internally.

Customer Outcome: 👉 AI that thinks economically 👉 Higher ROI per task 👉 Automatic cost-performance balancing

Economic Optimisation (Flagship / Advanced)

Goal: Turn your AI ecosystem into a self-optimising economic engine.

This is where the platform becomes a continuous profit optimisation layer across all AI operations.

What you get:

Self-optimising MAS Agents continuously learn how to reduce cost while maintaining or improving outcomes.

Margin Optimisation Loops System-level feedback loops that actively maximise profitability.

Profit-aware Workflow Design Simulate profitability before deploying new AI workflows.

Autonomous Pricing Recommendation Suggests optimal external pricing for AI services based on real internal costs.

Enterprise AI Cost Marketplaces Internal market where teams can trade AI capabilities based on supply, demand, and value.

Customer Outcome: 👉 Continuous margin improvement 👉 Data-driven pricing strategy 👉 Internal AI economy that allocates resources efficiently

See content credentials

AI FinOps & Unit Economics for CFOs

A working group for CFOs responsible for managing real-world AI spend, optimisation, and commercialisation.Focus areas:

* AI cost forecasting and variance control

* Token, inference, and orchestration cost governance

* AI workload profitability modelling

* Vendor concentration and model diversification risk

* Scaling AI without linear cost growthBuilt for finance teams deploying AI in production — not just evaluating it.