The Buffett Rule for the AI Age: Why High Intelligence and Energy Are Your Biggest Liabilities

In the high-velocity theatre of modern global strategy, few management filters have remained as resilient as the one popularized by Warren Buffett. Speaking to Columbia University students in 1993, Buffett shared a classic yardstick for talent that has since become a cornerstone of executive hiring. Yet, as he was careful to note, he wasn't the originator; he was merely the one who understood its lethal implications.

The rule is deceptively simple: look for Integrity, Intelligence, and Energy. But in an era where "Agile Operations" are powered by "AI Truth Accelerators," this timeless advice has taken on a more predatory edge. Why are the traditional virtues of high intelligence and high energy now your company's greatest liabilities? Because without the anchor of integrity, they aren't just assets—they are accelerators of corporate self-destruction.

The "Killer" Combination: Why Integrity is Non-Negotiable

The core of the "Buffett Rule" centers on a warning about the destructive power of unanchored talent. In a world of hyper-automated systems, this warning is no longer just metaphorical; it is a description of operational risk.

"Somebody once said that in looking for people to hire, you look for three qualities: integrity, intelligence and energy. And if they don’t have the first, the other two will kill you." — Warren Buffett, 1993.

Without integrity, intelligence and energy become instruments of "Gross Architectural Negligence." In the eyes of modern law, this failure to anchor capability manifests in the Caremark claim, a doctrine of oversight liability that is currently undergoing a radical expansion. Traditionally targeting directors, Delaware courts have recently extended Caremark liability to corporate officers, raising the personal stakes for every member of the C-suite.

To understand the legal weight of the integrity test, one must look at the two prongs of a Caremark claim:

• Prong One: The Information Systems Claim. A failure to implement reporting or information systems to monitor business and legal risks.

• Prong Two: The Red-Flags Claim. A conscious failure to monitor operations or respond to warnings after systems are in place.

When high-intelligence systems function without rigid ethical oversight, they create "Red Flags" that are now discoverable by AI-driven audits. If your technical and risk witnesses are not "in the same building"—metaphorically or operationally—regarding AI oversight, you are essentially signing your own legal confession.

Intelligence at Atomic-Level Precision: The Liability of Speed

In 2025, intelligence is no longer purely a human trait; it is a physical characteristic of manufacturing. Taiwan Semiconductor Manufacturing Company (TSMC) exemplifies this, utilizing intelligent manufacturing systems to achieve "atomic-level precision" in process control.

This hyper-intelligence achieves:

• Accelerated Learning Curves: Using AI to optimize cutting-edge process technologies.

• Convergence of Variation: Reaching atomic-level precision through advanced algorithms.

• Global Consistency: Integrating IoT and edge computing across multiple "mega fabs" to ensure uniform quality.

However, from a strategic governance perspective, this intelligence is a double-edged sword. Hyper-intelligence is a liability because AI-driven errors scale at the speed of light. Without a robust "quality defense" (Integrity), a single "intelligent" manufacturing flaw can propagate into a global catastrophe before a human can even intervene. Intelligence without integrity doesn't just make a mistake; it optimizes the disaster.

The "DOA" Strategy: Energy's Double-Edged Sword

In the modern corporation, "Energy" is fueled by data vitality. Yet, most data is DOA—Dead on Arrival. The DOA Framework (Defend, Organise, Attack) illustrates how data energy must be harnessed through the corporate lifecycle.

A company’s "Energy" (Attack) ratio shifts as it matures:

• Birth (Startup): Heavily skewed toward Attack. The mission is market penetration and customer acquisition.

• Growth: Continued Attack but with a rising need to Organise to prevent scaling bottlenecks.

• Stability (Maturity): A shift toward Defend and Organise to safeguard market share and profitability.

• Decline/Reinvention: A resurgent need to Attack to identify new markets.

The "Energy" of a startup—High Attack—is a major legal liability because "speed to market" often bypasses the "Defend" (governance) protocols. This creates a backlog of "Red Flags" that eventually trigger Caremark claims. The Chief Data & Analytics Officer (CDAO) must act as the "orchestrator of clarity," ensuring that data energy is activated, not just stored, to prevent strategic guesswork from becoming a liability.

The Truth Accelerator: AI as a 24/7 Audit

AI has transitioned from a processing tool to a "Truth Accelerator." It performs a continuous, 24/7 audit of organizational coherence. If your strategy and your execution are incoherent, AI doesn’t just reveal the gap—it provides a permanent, discoverable record of the lie.

In this environment, Coherence is no longer a strategic luxury; it is a Duty of Care. Regulators now treat the inability to explain the "how" and "why" of an AI’s output as a disclosure failure and a breach of fiduciary duty. When technical teams and risk teams operate in silos, the resulting "Gross Architectural Negligence" becomes a personal subpoena for the officers involved. You cannot plead the Fifth when your own models have already signed the confession.

Strategic Hegemony: Investing in Human Energy

Sustaining the "Energy" part of the Buffett Rule requires more than just processing power; it requires a workforce that hasn't been rendered obsolete. JPMorgan Chase (JPMC) is currently executing a move of Strategic Hegemony by investing in human energy to prepare for the "extraordinary" impact of AI.

JPMC’s workforce strategy is defined by two distinct, high-impact pillars:

1. $350 Million Global Workforce Investment: Targeted at removing barriers and upskilling workers to meet the demands of the labor market.

2. $300 Million Annual Training Budget: Dedicated to employee training, diversity, and inclusion to drive innovation and profitability.

By investing in apprenticeships and reducing barriers between education and employment, JPMC is ensuring its workforce doesn't become "Dead Data." Supporting the local workforce is a "long ongoing journey" that ensures human energy remains a competitive asset rather than a stagnant liability.

The Global Jurisdictional Assemblage: Integrity Beyond Borders

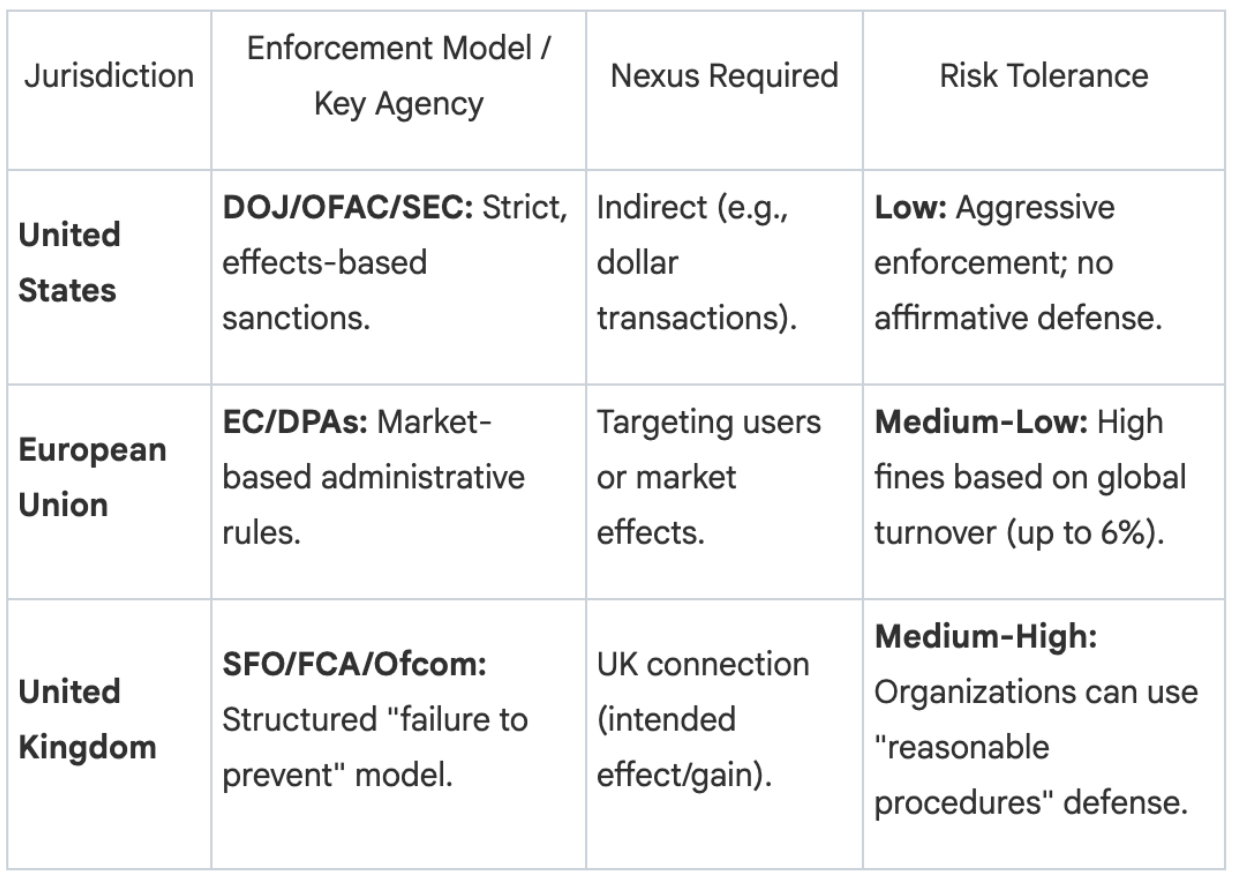

Integrity is increasingly defined by how a company navigates the "jurisdictional assemblage"—a web of extraterritorial laws like the GDPR, the Digital Services Act (DSA), and the EU AI Act. The "Brussels Effect" means that EU standards are being exported globally, often clashing with the "American Counter-Narrative."

This landscape is further complicated by the American Counter-Narrative, championed by figures like Vice President JD Vance, which frames European content regulations (like TERREG) as potentially incompatible with First Amendment free speech protections. As digital sovereignty becomes a "reputational balancing act," the United Nations has emerged as a potential mediator. Through its Digital Cooperation Roadmap, the UN seeks a path toward global convergence, offering a neutral forum to resolve the fragmentation of the internet.

Conclusion: The Audit of Integrity

In an "unbound" legal environment, cross-border compliance and high-performance operations are no longer siloed functions—they are foundational to brand legitimacy. High intelligence and high energy are powerful engines, but without the integrity of robust technical and organizational measures, they simply accelerate your path toward a regulator's desk.

In this new era, platform governance is no longer a technical function; it is a public performance and a political negotiation. As you examine your organization's trajectory, you must ask the defining question of the AI age:

In five years, will your AI be your most sophisticated witness for the defense, or the lead witness for the prosecution?